19th August 2020

Introduction

Over the past year we have closely followed the progress of Marks & Spencer (M&S), initially publishing a blog “Not Just a Loss But…” on the 7th September 2019 and followed shortly afterwards on the 7th November with another thought-piece “Where to Next for M&S?”. Since then we have continued to review the progress of the company.

Whilst the numbers can never be described as “good,” we have an increasing sense of concern regarding the longer-term future of the business. Indeed, the announcement on the 20th July that 950 jobs were to go followed by another round of redundancies announced on 17th August with a further 7,000 jobs only adds to the sense that the business is increasingly in a precarious position which was unimaginable even 5 years ago.

On the 21st July, Mary-Ann Russon of the BBC published a critique which is summarised below;

“M&S: Five reasons the retailer is struggling.”

1. ‘M&S doesn’t appeal to any generation’ – “In trying to be everything to everyone, they’ve ended up being nothing to no one,” says Natalie Berg, retail analyst at NBK Retail. Kate Hardcastle, another retail expert agrees: “Generally they have got a 25-year-old model wearing garments targeted at a 65-year-old, who doesn’t feel included.”

2. ‘M&S too often makes bad decisions’ – Experts pointed to the unsuccessful Sparks Card loyalty scheme which had to be recently re-launched. Further comment from retail analyst Chris Field cast doubt on the price paid for the new relationship with Ocado. We will see… the article makes reference to new senior executives joining the business; one of whom is from Tesco, a business that had a share price of £2.86 in June 2014 when the previous CEO was released from the business – over six years later the current share price is £2.25 but apparently Tesco is now “transformed.” Evidently, we live in strange times…

3. ‘M&S doesn’t listen to its customers’ – Ms Hardcastle argued that M&S’ traditional base of over-45s feel neglected – “They don’t connect with customers enough, so they never know what the customers want…”

4. ‘It needs to invest more in its stores’ – Ms Berg said “If you were launching a retail business today, you wouldn’t dream of recreating the M&S model. We just don’t go into department stores anymore.”

5. ‘Iconic but not immune’ – despite the problems outlined within the piece the brand is still trusted – coming 9th on KPMG’s Customer Experience Excellence List. However, Ms Hardcastle added “People loved them and what they stood for. They traded on that emotion, but they’ve not invested in the brand for so long and that’s why people get mad and sad about it”

This BBC Online Business section piece is perfectly pitched for its target audience.

However, there is a lack of a sound economic framework with accompanying data, no competitive dimension, no investor context and it is left open to the reader to interpret what exactly is meant by “it needs to invest more in its stores” – how much is “more?” £500m? £1bn? More than that? At what kind of pace should this investment be undertaken? It is a criticism that could be levelled at a number of the company’s competitors from Next through to Tesco…

Given the success of Amazon and online sales in general, one might question whether less emphasis on the physical real estate was perhaps a more pressing strategic imperative – it is entirely possible that a value-maximising strategy could encompass less but more attractive stores and a much more powerful and convincing online presence. The comment from Ms Berg that “We just don’t go into department stores anymore” cannot be taken too seriously even though one understands the broader sentiment, even in these troubled times. M&S’ 2020 turnover of almost £10.2bn does rather suggest that department stores remain an important part of the sales mix. Nevertheless, the notion that department stores are at the forefront of retail cutting edge is clearly more open to challenge.

Furthermore, a number of ‘big’ brands are finding life increasingly difficult. Woolworths was arguably one of them but is no longer with us, Virgin Atlantic has just filed for bankruptcy in the USA, as has Hertz. One does wonder whether the M&S brand has any significant relevance to people, say, under 35 years of age? In other words, an “iconic brand,” in itself is not a guarantee of corporate success or longevity and strategic discussion around this is in danger of confusing cause and effect.

Assuming that the issues cited as being all that is wrong with M&S are indeed valid, the question is how to begin the process of deciding between allocating more resource to “listening to the customer,” and “investing more in stores?” without the necessary economic framework to provide guidance.

In addition, the BBC article’s focus on job losses and the terrible impact on people and their families is entirely valid. The share price and its trajectory also demands near-equal billing. Why? Whilst arguably not as immediately understandable, most people with some form of pension investment in the UK will have exposure to M&S through their regular saving / pension plan and yet rarely has the management team of such a large company been asked about the value of their company on the capital markets (and its direction).

M&S Share price performance (at date of the last six balance sheets):

| Date | M&S share price – p |

| 31 March 2015 | 535.0 |

| 31 March 2016 | 406.2 |

| 31 March 2017 | 337.0 |

| 31March 2018 | 270.2 |

| 31 March 2019 | 278.9 |

| 31 March 2020 | 99.2 |

As the table above illustrates, since the end of March 2015 the share price has fallen 435.8p or 81.4% – clearly the capital markets are not convinced by the company’s current strategy. Of course, trading on the UK High St. has been particularly challenging over recent years so it could be argued that much of the share price decline has been due to a wider market perception regarding the retail environment.

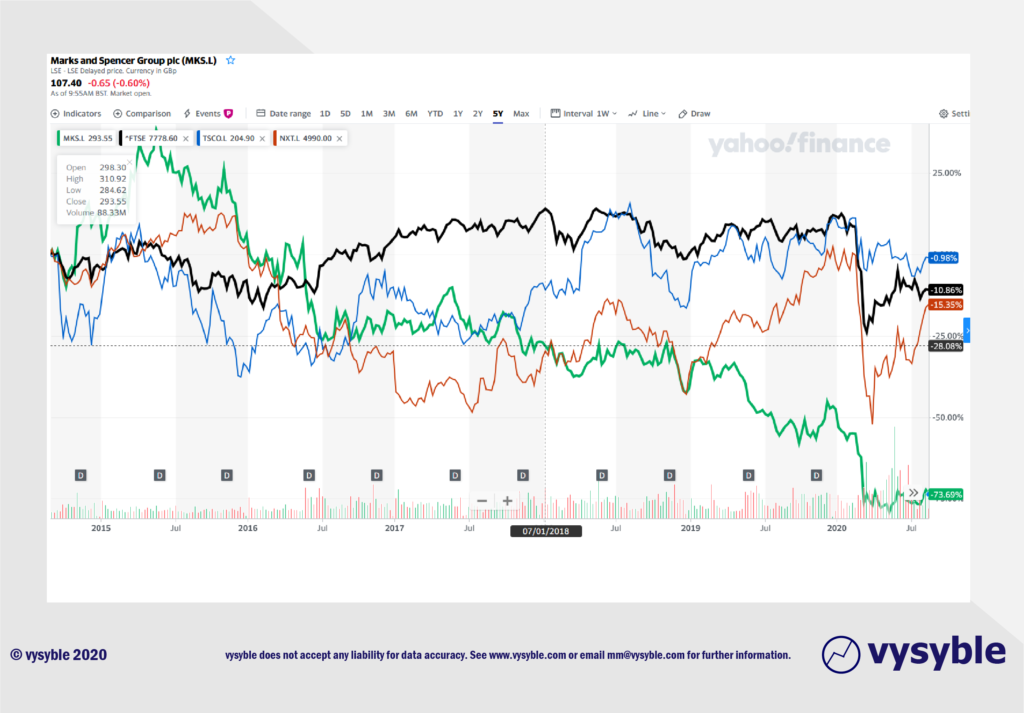

Set out below is the 5-year performance of M&S against, the FTSE 100, Tesco and one of our favourite retailers Next plc.

M&S has underperformed the FTSE 100, Tesco and since 2018, Next plc. Only Tesco has produced capital market returns ahead of the FTSE 100.

Accounting and Economic Performance

Regular readers of our material will appreciate that although the capital markets can have periods of both exuberance and pessimism, we believe that over time the best internal surrogate for the behaviour of the share price is economic profit – a metric defined as Net Operating Profit After Tax (NOPAT) less a charge for all of the capital used by the organisation. It is also a measure that encompasses all of the costs of doing business.

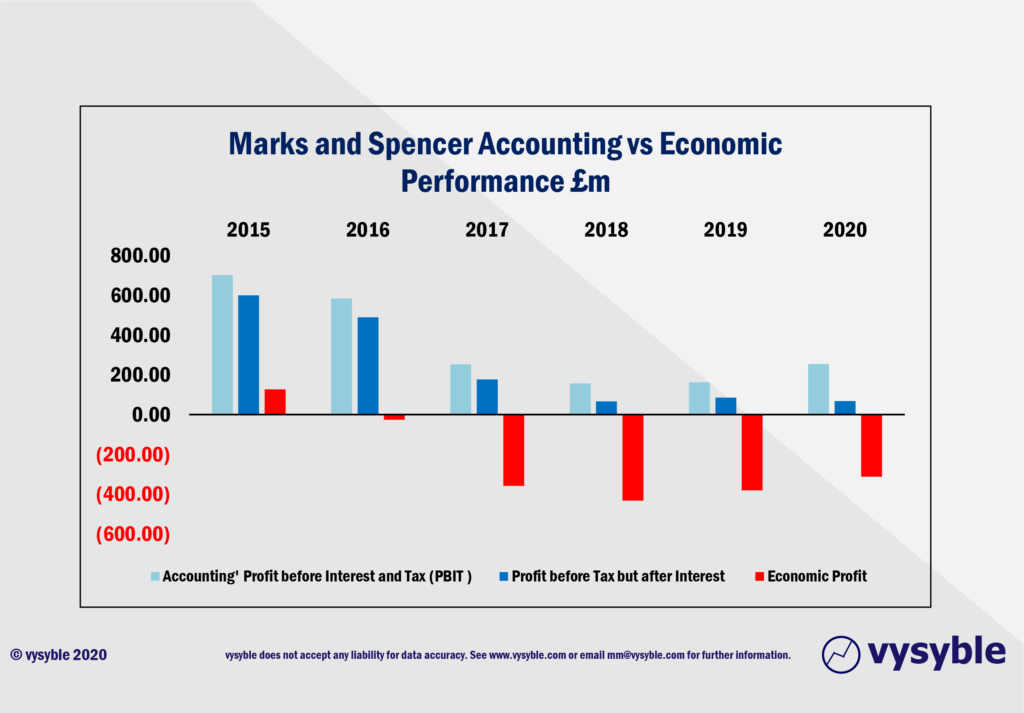

Below is the accounting and economic performance of M&S over the six-year period 2015 through to 2020

What does this chart actuall tell us?

- Between 2015 and 2020, all three metrics show a decline in performance; PBIT falls from £701.3m in 2015 to £254.8m in 2020, Accounting Profit after interest also falls from £600.0m in 2015 to £67.2m in 2020 and the economic performance moves from a surplus of £127.2m in 2015 to a deficit in 2020 of £312.5m – a worrying turnaround in performance of £439.7m (per annum).

- Between 2015 and 2020, PBIT and profit after interest but before tax totalled £2.1bn and £1.5bn respectively. Although trending downwards, both metrics suggest that the business is “creating value”.

- Such a perspective inclines management teams to the view that more “growth” or protection of existing revenue is a solution to a falling share price.

- However, over the same period (2015-20), the economic loss came in at a staggering £1.4bn.

- Under the more rigorous and demanding economic metric, the strategies deployed by the management team have resulted in a situation where M&S has not covered all of the costs of doing business since 2016.

- Viewed through this lens, the predominant problem is one of profitability whereby more “growth” could actually make the problem worse.

- Therefore, the economic performance strongly suggests that the share price collapse is due to the fundamental returns from the business rather than any prejudice, exuberance or capriciousness on the part of the capital markets.

Economic Performance vs Next plc and JD Sports

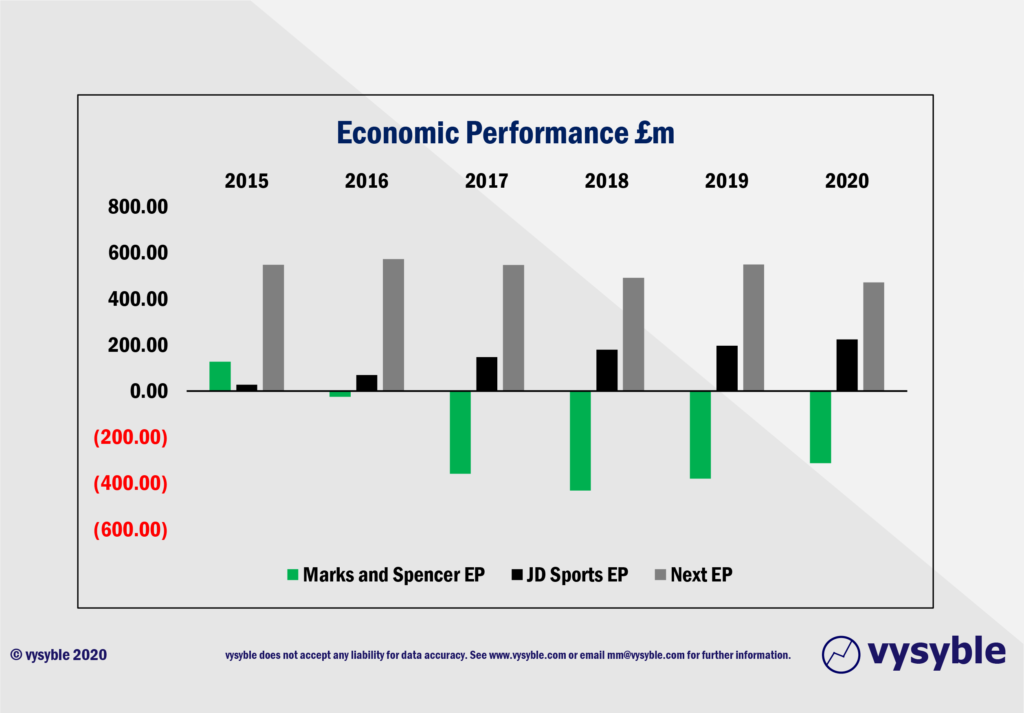

Of course, the notion regarding the challenging retail environment across the UK is both common and influential. Below is the economic performance of M&S against two other High St. staples, Next plc and JD Sports.

- The retail environment maybe difficult but both Next and JD Sports have found and prosecuted strategies producing both healthy and impressive levels of economic profit.

- Over the above period, Next plc has produced a pool of EP totalling £3.2bn and whilst the level of EP in 2015 at £547.8m is £76.9m ahead of the 2020 surplus of £470.9m, the business is still performing strongly, particularly in the current climate.

- Similarly, JD Sports has produced an impressive EP pool of £0.8bn with EP rising from £27.3m in 2015 to £224.0m in 2020.

- Whilst Covid-19 has challenged retail businesses, it is not the root cause of the problems at M&S which we believe are long-standing.

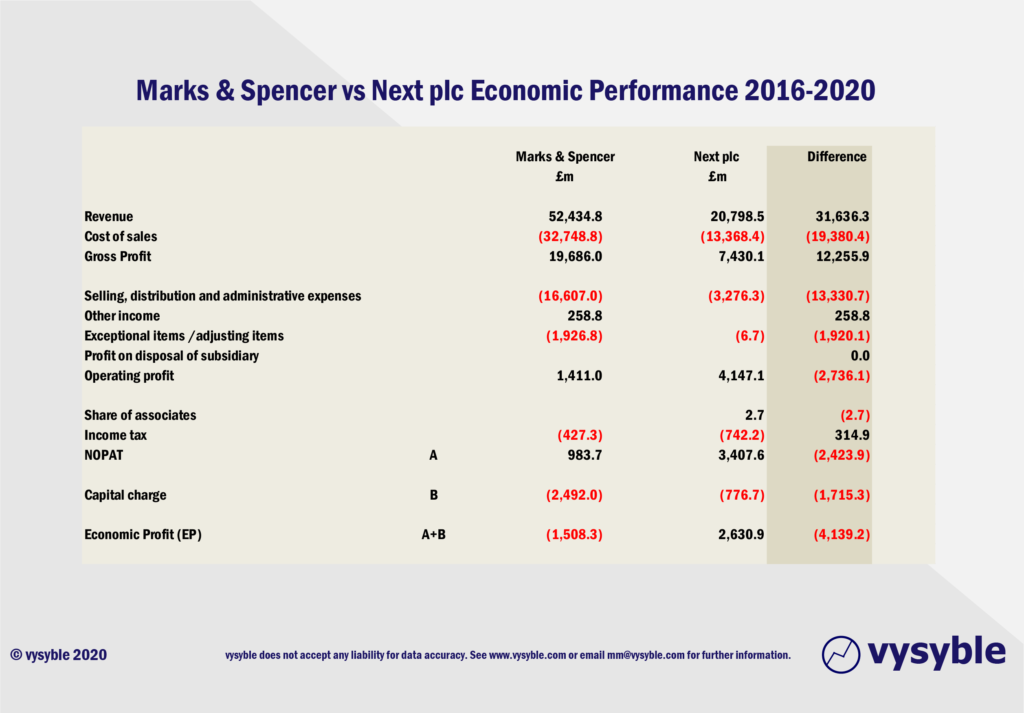

The five-year side by side 2016-20 analysis highlights the gulf in performance between the two companies. Over the period, M&S produces an economic loss of £1.5bn from a total turnover of £52.4bn against Next’s economic surplus of £2.6bn from revenues of £20.8bn.

Indeed, for every £1 of revenue over the 5-year period and including all of the costs of doing business, the company is losing 3p. By contrast, Next plc achieves an economic surplus of 12.6p for every £1 of revenue. Total revenues for Next are ‘just’ 39.6% of the total achieved by M&S and, despite the above, many executives still cling to the misguided belief that revenue is always the route to outperformance…

Perhaps the more pertinent question is this – what does the management team of Next plc know that seemingly evades the senior team of M&S?

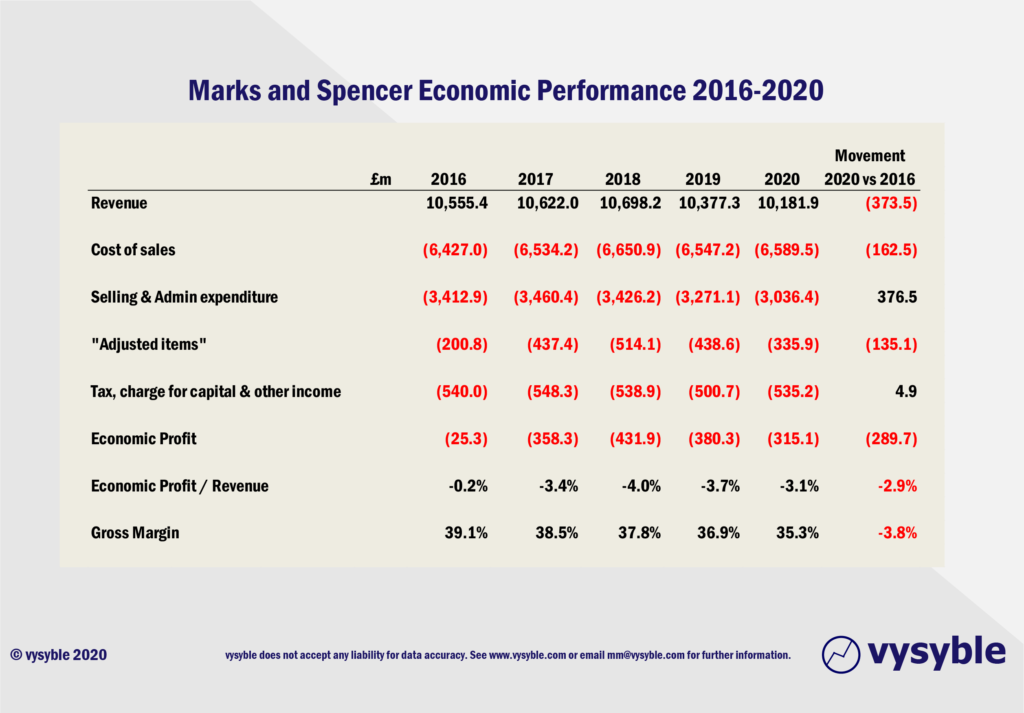

M&S economic performance in more detail

The above table shows that economic profit has fallen from a small shortfall of £25.3m in 2016 to a much more significant deficit of £312.5m in 2020. This is a negative movement of £287.1m.

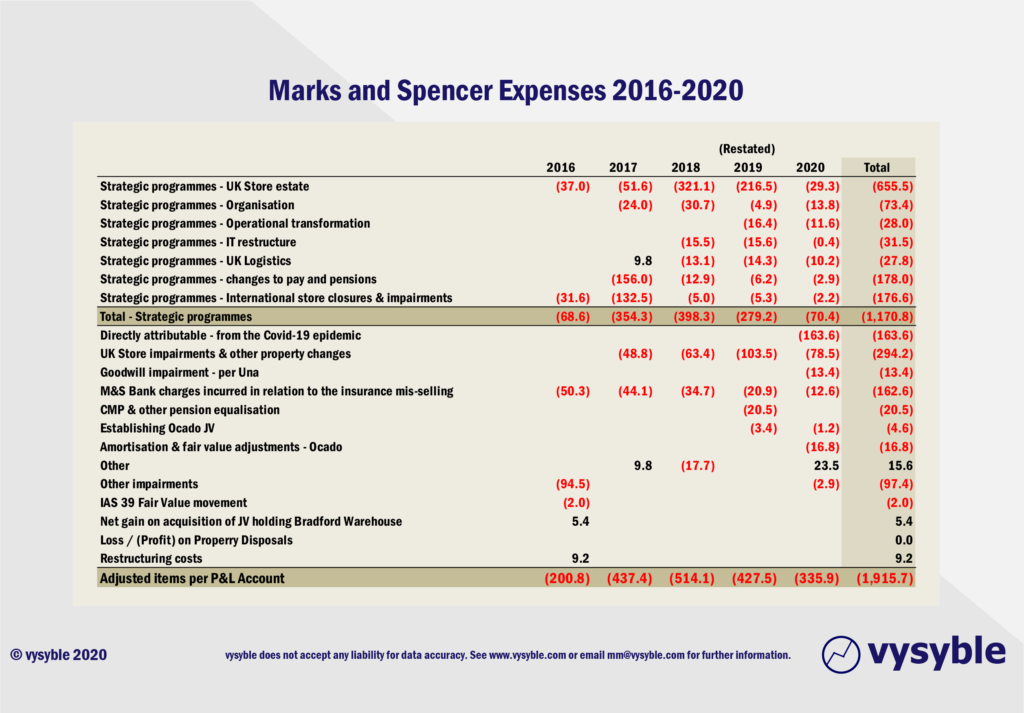

The “Adjusted items” line reveals additional expenditure on strategic projects as the management team seek to turn the business around.

During 2016-20, £655.5m or 33.1% of the £1.97bn spend on “adjusted items” was committed to the “UK store estate” – presumably in an attempt to upgrade or “invest in stores”. Perhaps Ms Berg, quoted in the BBC piece highlighted earlier, is either unaware of this, would like more to be spent or believes that the £655.5m has not been wisely invested?

As can be seen from the expenses breakdown, the company has devoted a significant proportion of the sum to matters concerning its property portfolio. Whilst we may not agree with the current strategy, the management team cannot be accused of not allocating resource to deal with the issues associated with bricks and mortar.

The share price, messages and the management team

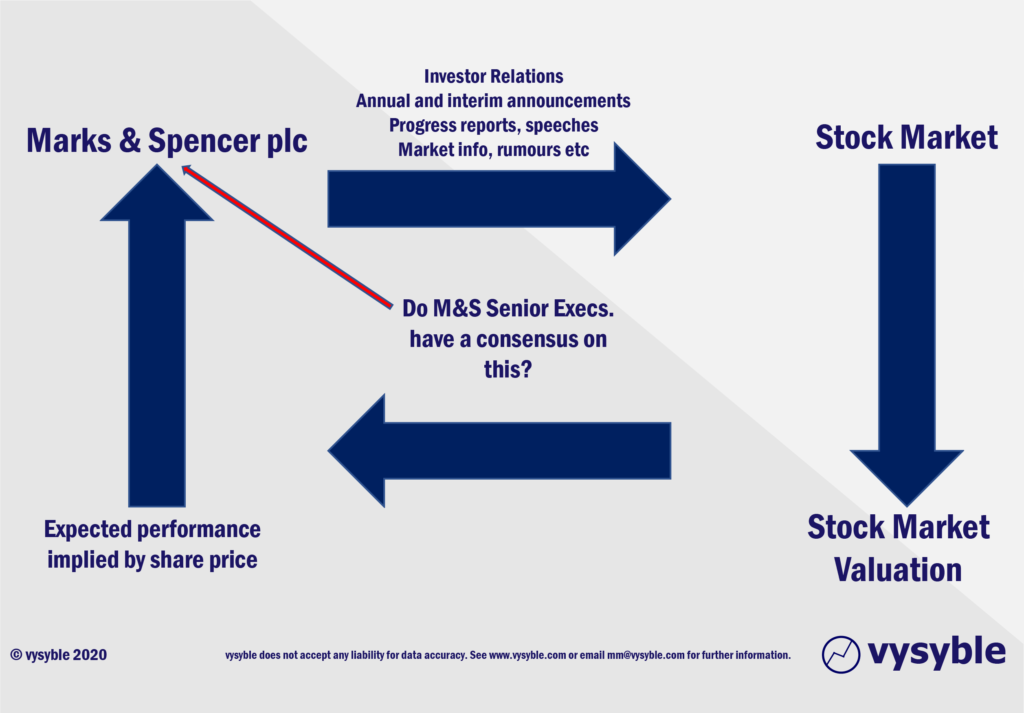

It is our contention that publicly quoted companies are constantly engaged with the capital or stock market, much like the diagram below:

The company releases information to the markets via press statements, annual reports, investor updates etc. In turn, the capital markets process these inputs as well as relevant information from other sources and the share price is, in effect, the collective wisdom of the market regarding the company’s future prospects all compounded into one number. The share price is also a signal to the company regarding the level of value creation required if shareholders are to earn their required rate of return.

From our perspective, a company’s share price is the clearest measure of market expectations about is future performance. Chairman, CEOs and Senior Teams are frequently and intensively focused on how the market values their respective companies.

Capital Market sceptics

Many are indeed sceptical of a process that seems to depend on some forecast regarding a very uncertain future, particularly at the current time. The argument goes that if a management team is unable to ascertain what is going to happen then how can the market? In this instance the market cannot have the depth of knowledge that the management team has regarding the company under their stewardship, but it has a much broader insight into future developments which statistically is often superior to the perspective of senior management.

Furthermore, investors, commentators and even some consultants struggle with the idea that the capital markets reflect what the company is truly worth. Some argue that that the stock market is guilty of “short-termism” or some other form of investor prejudice. This is supposed to be a consequence of the persistent failure of the share price to reflect the longer-term value of the company. Such an argument was particularly prevalent in the 1980s as an initial defence against the trend for hostile takeovers, most notably in Wall St. circles.

However, the claim that the share price is not a good measure of value, at least from our perspective, rests on two in-going assumptions:

- The capital markets misprice the value of a company’s ordinary shares – more often than not this means “under-price”.

- The management team make strategic decisions using more insightful and robust metrics than those employed by professional investors.

This is a huge subject and something that we will no doubt return to but the evidence and decades of data strongly suggests that both of the above assumptions are indeed wrong and that the share price remains the most fruitful source of corporate value assessment.

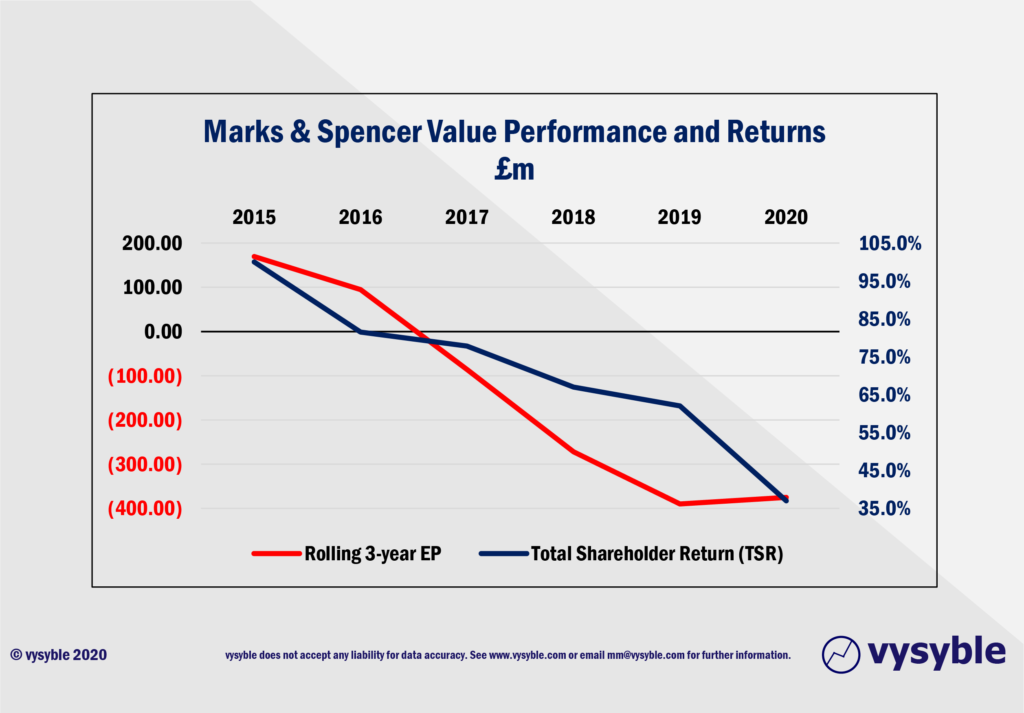

Set out below is the total shareholder return (TSR) for Marks & Spencer since the beginning of 2015 (re-based to 100) and the rolling 3-year economic profit performance, again since 2015, but also incorporating data from 2013 & 2014.

The relationship between the falling EP profile over time and the trajectory of the share price seems clear and unmistakable. In other words, the fall in the M&S share price is driven by the decline in EP delivered by current strategies.

Market To Book

Some clients, at least initially and to an extent understandably, find the outputs from the economic profit calculations profound, disturbing and confusing. In client work, we have observed and experienced all of the symptoms of shock and grief as managers struggle with the magnitude of the realisation that the business and its economic context that they have been grappling with is so very different from their original perception.

Occasionally, and again to an extent understandably, they question the calculation – it is not unusual for some sort of irrational attack on the in-going assumptions and is seen as trying to deflect from the disturbing truth of the economic profit message. That said, some of the truly great CEOs (Sir Brian Pitman, Sir John Sunderland, Roberto Goizueta) appreciated the power of the approach which is to bring the discipline of the stock market inside the organisation.

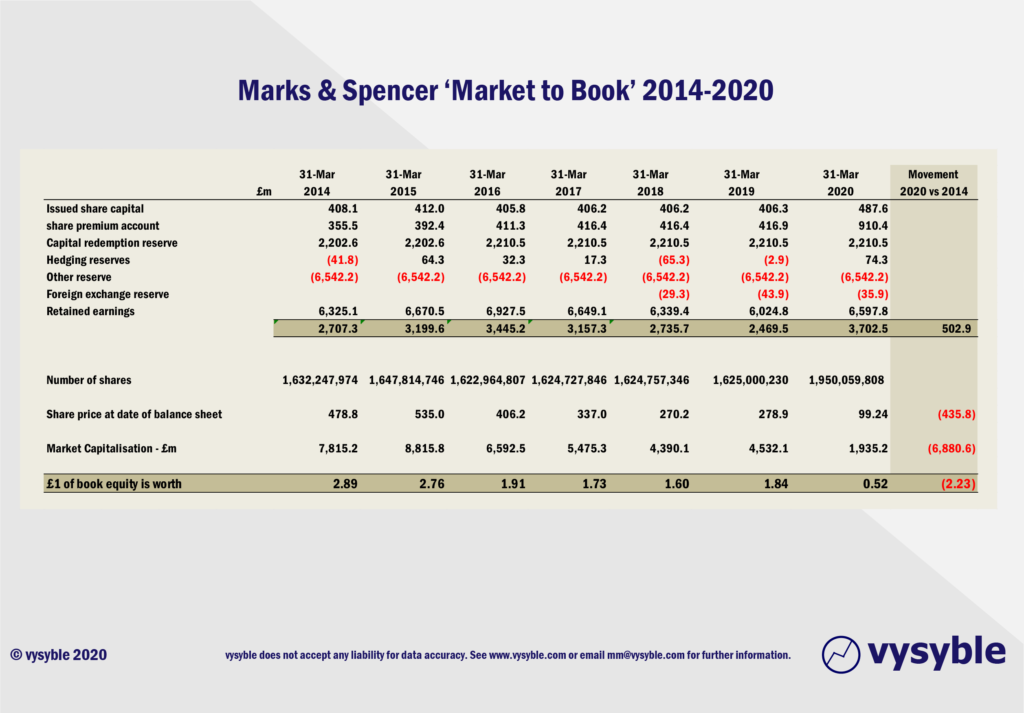

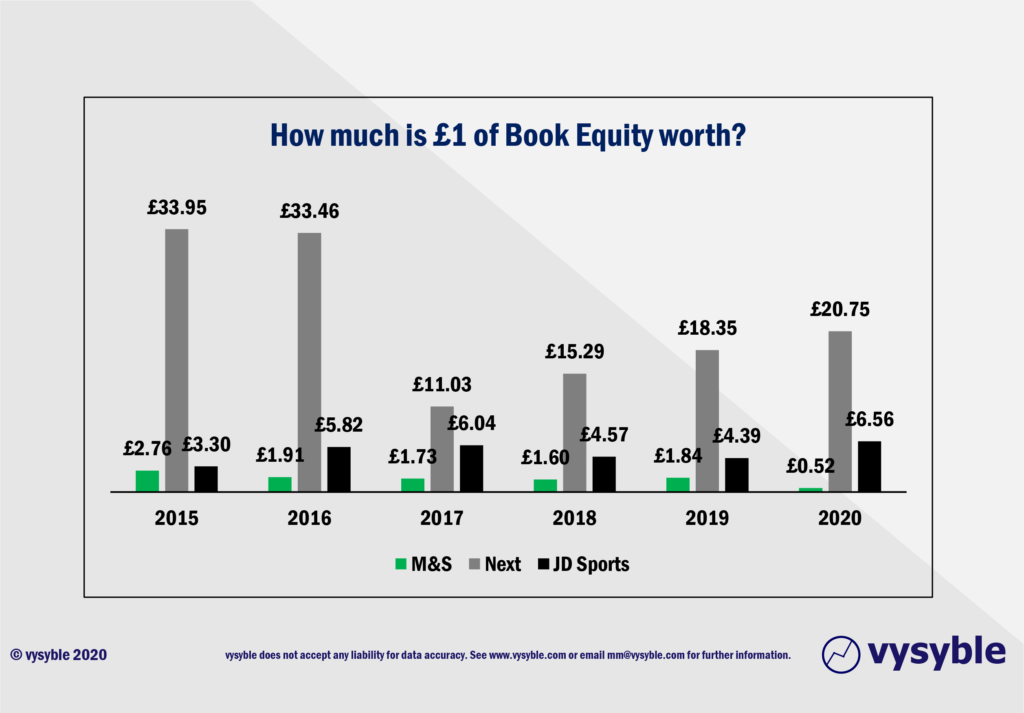

Against this background, we can calculate “Market To Book” which essentially asks the following question– what is £1 of book equity worth on the capital market at the date of each balance sheet? Although not as comprehensive or powerful as the economic profit perspective, there is only one share price and only one balance sheet per reporting period. The resulting output can help as a stepping stone for the senior team in their quest to absorb and understand the more challenging economic profit picture.

Unfortunately, the strategies adopted by the M&S senior team have resulted in £1 of book equity having a value on the capital markets of 52p at the end of March 2020 – down from £2.89 in March 2014; a fall of £2.37 or 82%. Highly disturbing stuff.

Given the above, it almost inconceivable that M&S has been covering ALL of the costs of doing business in recent years.

Meanwhile, both JD Sports and Next have been achieving the exact opposite of M&S by creating value on a regular basis despite the ‘precarious’ nature of UK retailing.

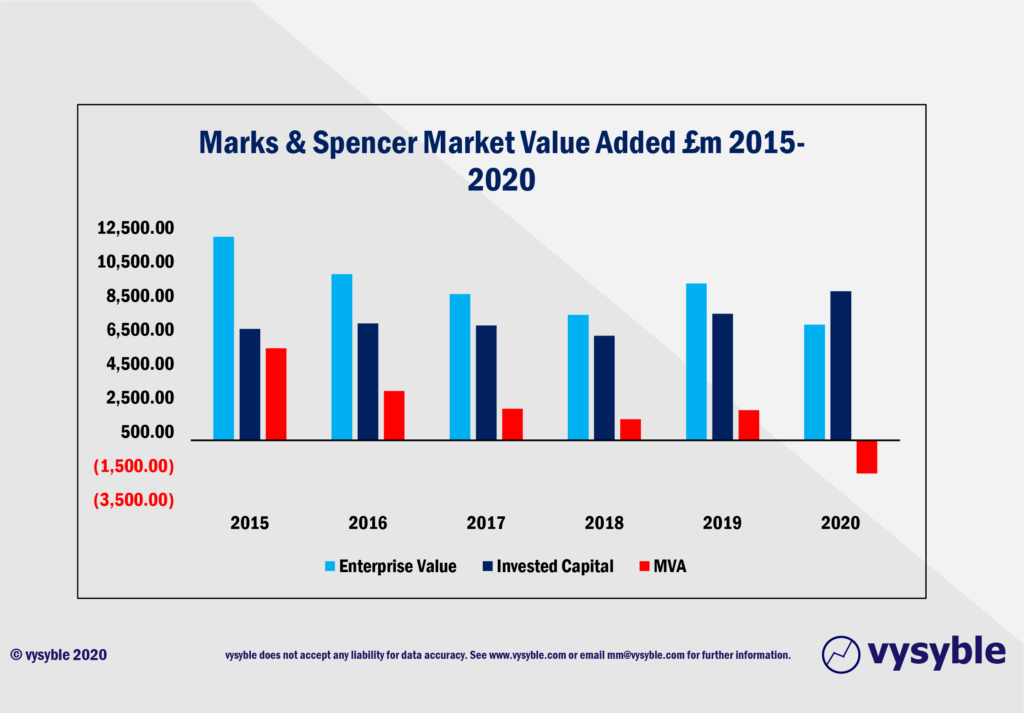

Market Value Added

One approach taken to unpick the quantum of “expectations” within the share price is to calculate the Market Value Added (MVA) position, ideally over time. In this context, MVA is equivalent to Enterprise Value less Invested Capital and in effect represents the market’s collective view of the future stream of value creation (for a given share price).

MVA has fallen from £5.4bn in 2015 to a negative £1.95bn at the end of March 2020 – a jaw dropping turnaround in capital market perception totalling £7.35bn over 5 years. In other words, based on the share price at the date of the last balance sheet, 99.24p, the stock market is not expecting M&S to cover its costs going forward.

Recent months have seen an upward movement in the share price and at the time of writing it sits at 116.75p – if we recalculate the MVA position using this price and the last published balance sheet, then despite the share price improvement, MVA still remains in negative territory to the tune of £1.6bn. For MVA to be zero, the share price, all other things being equal, needs to reach 199.57 – a 71% increase on the 116.75 current price (at time of writing).

Conclusion and further thoughts

Founded over 130 years ago, M&S is a huge business with a turnover in excess of £10.0bn, over 78,000 employees (as per the latest annual report) and 31 million customers. Turning a business around of that size and complexity is not unlike changing the direction of an oil tanker stuck in the English Channel – it needs to leave the narrow strait before the turning circle is large enough for it to significantly change direction. In other words, it is challenging, it takes time and there are multiple trade-offs.

However, the current Chairman, Archie Norman, who admittedly comes with a formidable reputation, joined the business on 5th May 2017. The closing share price that day was 356.21p. He has had over three years to initiate change. At time of writing, the M&S share price is 116.75p – some 67.2% lower than the share price on the day Mr Norman became Chairman.

No doubt the company has the usual coterie of Bain, Boston Consulting Group, McKinsey, and a fair smattering of retail consultant specialists all trying to help. We wish them luck. However, it is hard to avoid the overwhelming conclusion that the current strategy for the business is just not working.

Over a sustained period of time, the fundamental or economic performance of the business and the value of the company has been declining. No one is denying that the retail environment, even before the pandemic, is changing. However, whilst the external environment is undoubtedly demanding, the performance of Next, JD Sports and several others is leaving M&S far, far behind. Covid has merely added further focus to a patient that is already quite ill.

Just to emphasise again and probably for the first time in the company’s history, it’s MVA position is now negative – the combined wisdom of the capital market in total is taking the view that the business will NOT cover all of the economic costs of doing business from now on. Furthermore, £1 of book equity at the date of the last balance sheet had a value on the stock market of 52p – where or what has happened to the remaining 48p?

We believe that a full value audit of the business across of its activities should be undertaken urgently but frankly that is only the beginning of the process in addressing the problems facing the business. More fundamentally, there are a series of in-going beliefs and common errors which we believe are holding the business back. They include:

- The Stock Market

- Chairmen and CEO’s have the wrong idea about how the Stock Market values businesses and what that means for the business.

- They are awash with flawed ideas about how things like eps and EBITDA are drivers of value – just to be clear, these metrics are not just poor but grossly misleading indicators of value creation – even Mr Norman’s former employer’s McKinsey agree.

- The Objectives and Aspirations that are set for the business

- The most common error here is to drive the growth of revenue, often at apparently any cost, in the belief that it will always drive value up

- How Strategy is used to drive value

- Strategies end up being wishlists with no basis in the economic realities the business faces in its markets

- How Finance is used to give visibility of value creation and destruction

- Traditional accounting measures are used. These almost wilfully mislead managers about value creation and destruction

- How Organisations can be aligned with value so they can work effectively

- Organisation structures and ways of working are often not set up to clarify the accountability and responsibility for value. Decision-making becomes confused and slow

- How to give People the skill and will needed to manage value

- People get trained in many things: but not in how to drive the business for value. Incentive schemes frequently encourage value-destroying priorities and actions

- How to excel at Execution – at getting the right things done to drive value

- Execution can be left to more junior managers – somehow or other things will get done in a world of ever-shifting priorities

- How to drive and adopt Innovation across the business

- The business finds a myriad of ways to resist change – the institutional imperative.

Unfortunately, the notions outlined above lead to a perspective which is nothing more than a melange of disconnected concepts, “half-truths,” and unhelpful nonsense that worryingly have become “received wisdom,” over the years.

The brutal truth is this; the M&S management team is running a business that it believes is “profitable,” but is actually destroying value. The current strategy is fundamentally misaligned with the economic position of the business.

In the end, despite the rhetoric, the numbers do not lie. Put simply, the problems facing M&S are existential and to our minds are so much more challenging than the issues highlighted by the BBC article.

vysyble

Follow vysyble on Twitter