22nd May 2020

Introduction

A few weeks ago, we began an exercise seeking to establish a view on the economic impact of relegation from the Premier League combined with the potential effects of Covid-19. Since then we believe that the picture has become a little clearer with reports of a potential and partial TV rebate for the 2019-20 season and additional guidance from Public Health England regarding social interaction. In addition, we also have the statement from the FA confirming that relegation from the Premier League will occur, come what may.

Although not under the threat of relegation, the recent release of Manchester United’s third quarter results for the three months ending 31 March 2020 sheds more helpful light as the club announced that Covid-19 had hitherto ‘cost’ £23m. Initial reaction from many across the media focused on the sharp rise in the club’s net debt to £430m as somehow symptomatic of the virus. We take a different perspective and believe it is the result of the purchase of some players for cash (eg Maguire) whilst at the same time selling certain players (eg Lukaku) and receiving those payment in instalments. In other words and at this stage, it is a temporary cash flow feature and nothing more. That said, the next quarter’s numbers promise to be significantly more revealing regarding the impact of Covid-19. The fact that the club has withdrawn guidance regarding future financial performance speaks volumes…

Relegation

In turning our attention to the other end of the Premier League table, relegation under “normal” circumstances is bad enough for club financials without the complication of Covid-19. We know from our extensive database going back to 2009 that 2/3rds of clubs will achieve significant economic losses in that first Sky Bet Championship season, despite the injection of a sizeable parachute payment. On average, clubs will experience a 43.5% decrease in revenue given the latest 3 years of data.

We have based our upgraded calculations on an 18th place position (in the EPL) with a view to determining the economic outcome were relegation to occur. This is important when assessing the TV element (and any potential rebate) of total club revenue as it is partially merit-based.

Arguably, there are six clubs in the mix for a potential 18th place finish – AFC Bournemouth, Aston Villa, Brighton & Hove Albion, Norwich City, Watford and West Ham United. Three clubs will be relegated as confirmed by the FA and at the risk of incurring the wrath of fans from the former Olympic stadium, we will use West Ham United as our initial example in order to explain how we arrive at the numbers and to demonstrate the overall principles involved. We have previously examined West Ham United’s (predictable) financial performance in our 8th February 2020 blog entry – Hammered.

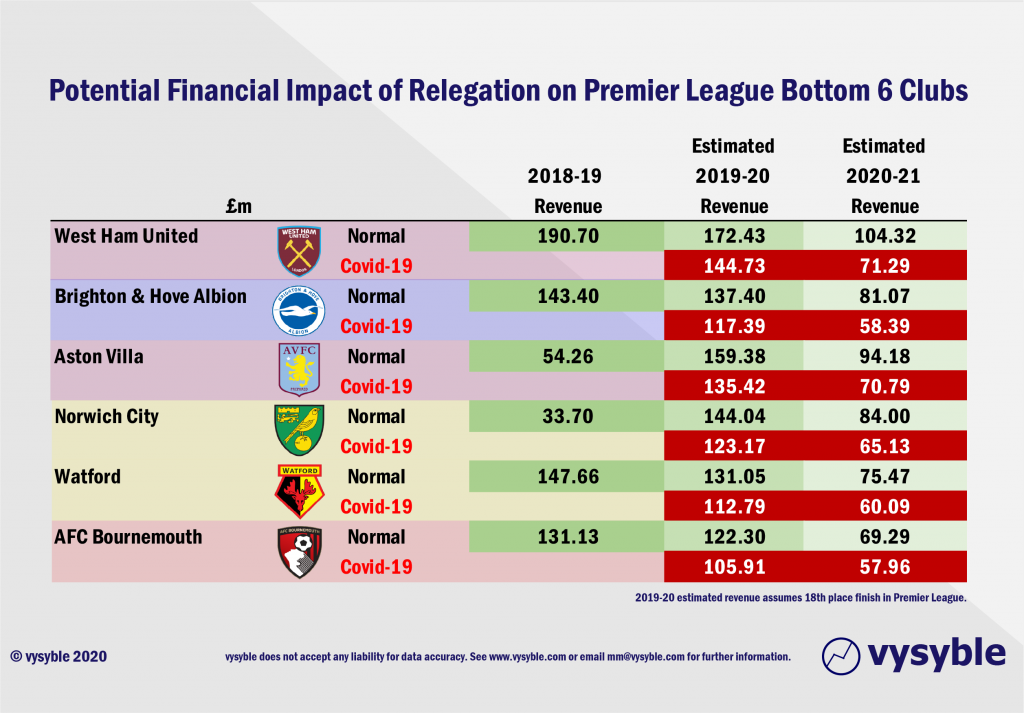

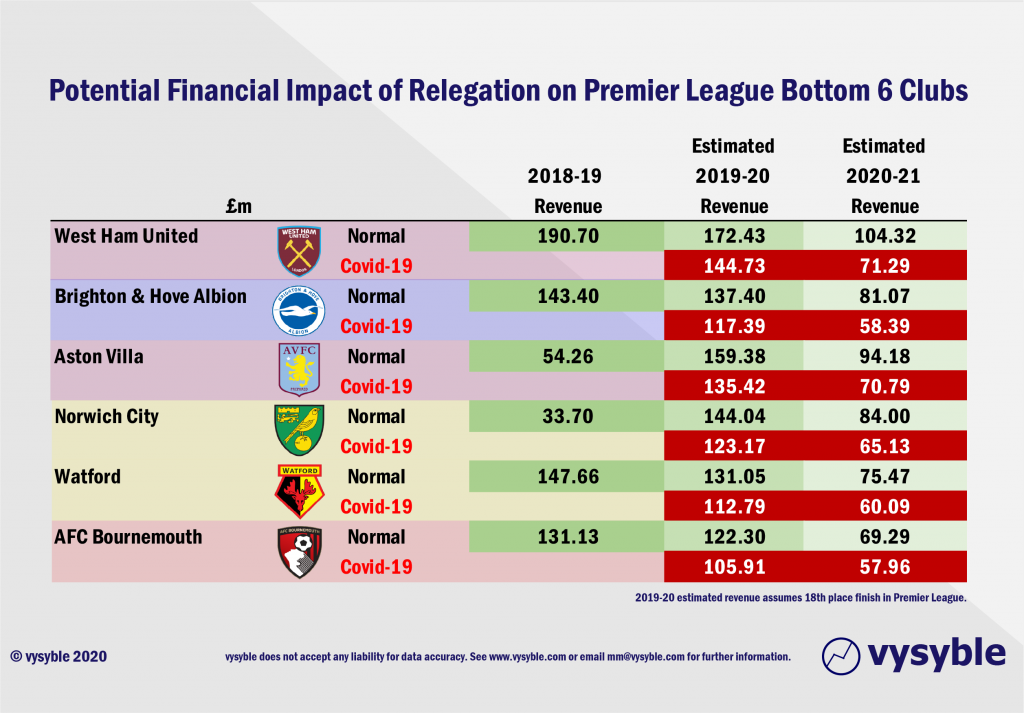

Below is the revenue progression from 2018-19 through to a first season in the Championship in 2020-21 under normal conditions (shaded green). The Covid-19 values (shaded in red) assumes closed door football (and other factors which are covered in detail further on in this blog) up to the end of the 2020-21 season along with a number of other diminished revenue streams.

This is a table of bad scenarios. You do not have to be an accountant to realise that West Ham United stand to lose an estimated £120m or so in revenue from the end of the 2018-19 season to the end of the 2020-21 season if the club is relegated and closed door football has remained in place. A revenue drop of this magnitude (approx. 62%) would finish off most businesses. The other clubs are not that far behind.

What follows are our thoughts and workings in terms of how we arrived at these numbers.

West Ham United’s 2018-19 revenue was £190.70m. This can be broken down into the three main revenue streams:

| TV | £127.42m |

| Matchday | £27.13m |

| Commercial | £36.15m |

To establish a revenue total for the yet to be announced 2019-20 season, we inflate the 2018-19 values for Matchday and Commercial by 5%. We will address the TV position separately. This gives us the following:

| Matchday | £27.13m plus 5% = £28.48m |

| Commercial | £36.15m plus 5% = £37.95m |

The TV value is driven by a combination of the final table position and a fixed monetary component. Therefore we have assumed a TV revenue value of £106m to all six clubs for 18th place. This is based on the previous 3-years of data corresponding to the 2016-19 TV cycle plus an estimate of values going into the 2019-22 TV cycle.

Thus under ‘normal’ conditions, we estimate West Ham United’s 2019-20 18th place revenue will be approx. £172.43m which can be broken down into;

| TV | £106.00m |

| Matchday | £28.49m |

| Commercial | £37.95m |

When clubs are relegated from the EPL into the EFL Championship, revenue drops significantly under normal conditions. In fact, the average decrease for clubs over the last 4 years per revenue stream is as follows:

| TV | – 45% |

| Matchday | – 21% |

| Commercial | – 38% |

Thus, the impact of relegation from a purely revenue perspective and under normal conditions would be a revenue reduction of approx. £68.11m or 39.5% for the Hammers.

However, as we all know, today’s world is anything but ‘normal’ so how do we go about estimating the potential effects of Covid-19?

The most obvious starting point is matchday revenue and closed door football. For 2019-20, West Ham United had played 15 of 20 scheduled home games in all competitions and will therefore miss out on the matchday revenue from those 5 remaining games, which we estimate to be £7.12m.

The TV position is more complex. We are aware that the TV companies – domestic and international – are seeking a reported rebate in the region of £340m-£350m over the remaining 92 fixtures. So far, we have seen reports that the two key reasons for this are scheduling and the closed door experience, which it is thought will limit sponsor and advertising opportunities.

Under normal conditions and using the 2016-19 TV cycle as a guide, there is a fixed element (approx. 67% of total TV revenue received – based on previous cycles) and a variable element determined by the number of live games featuring the club and also its final finishing position.

It would make sense to use the same agreed distribution formula in reverse, to estimate the level of reclaim from the clubs to the TV companies. At this stage there is a note of caution – the 2019-22 TV cycle payment structure has changed from previous years in that any increase in international revenues is paid based upon finishing position so we do not have clarity in terms of the actual numbers and individual club awards.

However, we will assume, given previous years, that 67% of the lower end of the rebate ie £340m, is paid equally by each club, which is £11.39m, with the remainder (£113m) paid on a sliding scale from a base of 0.47% of the outstanding total for 20th position up to a maximum of 9.52% for 1st place. 18th place is valued at 1.42% of the total, so £113m x 1.42% = £1.60m.

Thus an 18th-placed West Ham United would have to repay an estimated £11.39m + £1.60m = £12.99m in TV money.

This means that the impact of closed door football and TV rescheduling due to Covid-19 has hit the club’s 2019-20 revenue by an estimated £20.11m even before we take a look at the impact on commercial revenues.

We have seen various estimates ranging from a reduction of 10% up to a 40% impact on football club commercial revenues. For the remainder of the 2019-20 season, 96 scheduled games remain to be played across all competitions from a scheduled total of 470. This is 20.4% of the season’s total and does not include potential progress to next round of cup competitions etc. Should we assume a 20% hit to commercial revenues? Commercial contracts tend be long-term over a period of years although they may also be subject to performance clauses. However, we think that 20% is not unreasonable given that some contracts will be aligned to media exposure, related matchday purchasing activity and accessibility, player access and endorsements etc.

In West Ham United’s case, a 20% reduction in commercial revenue moves the dial from £37.95m down to £30.36m.

The net result is an estimated 2019-20 Covid-19 reduction of 16.06% or £27.70m leading to an estimated final revenue total of £144.73m, some £45.97m shy of the 2018-19 revenue total of £190.70m when the club also produced an economic loss of £31.66m.

Aston Villa and Norwich City

For the two promoted clubs languishing at the wrong end of the table – Aston Villa and Norwich City – we will again apply the £106m TV revenue value for 18th place and increase their 2018-19 Matchday and Commercial revenues by the 4-year average for promoted clubs ie 29% for Matchday and 92% for Commercial.

Thus, Aston Villa’s estimated revenue for 2019-20 is £159.38m broken down into;

| TV | £106.00m |

| Matchday | £16.44m |

| Commercial | £36.94m |

And Norwich City’s estimated revenue for 2019-20 is £144.04m broken down into;

| TV | £106.00m |

| Matchday | £12.51m |

| Commercial | £25.53m |

Relegation Revisited

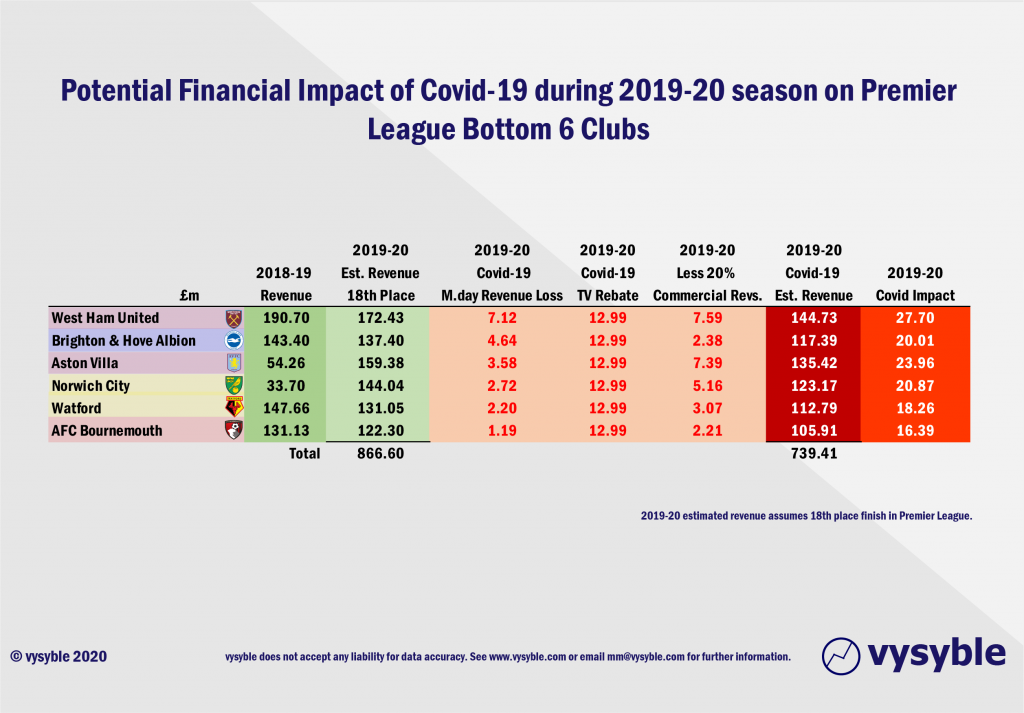

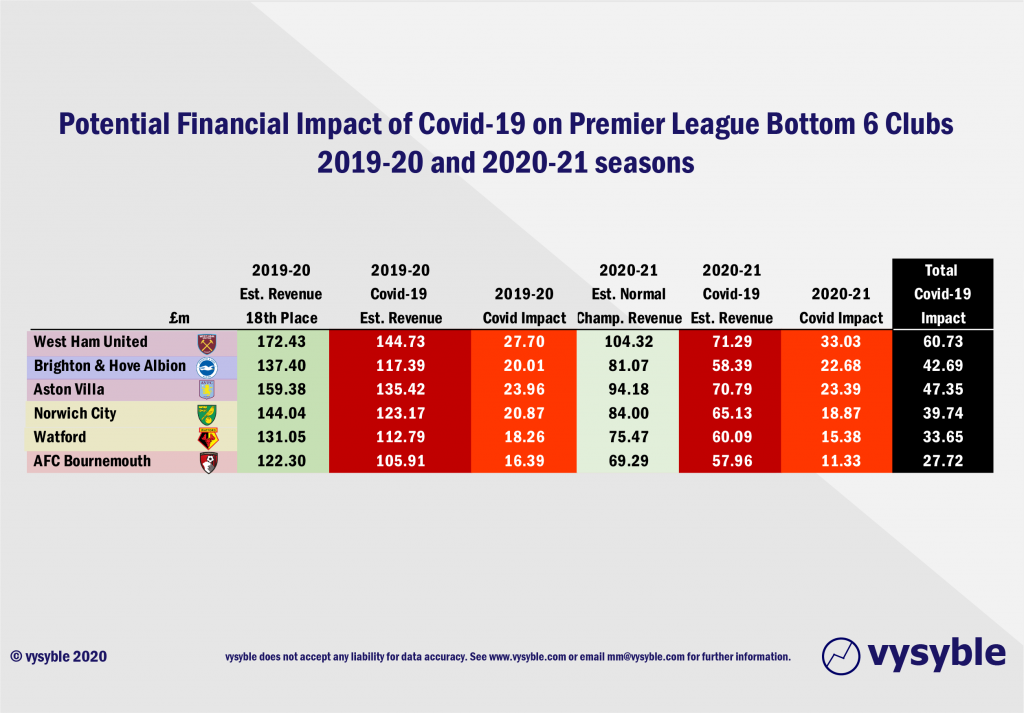

The table below highlights the potential effects of the virus should each of our six chosen clubs finish in 18th place.

By condensing the numbers, we can see the potential difference in revenue year-on-year.

Therefore, at the end of this season West Ham United could be relegated with a potential £45.97m revenue reduction from the 2018-19 season when the club achieved its highest-ever revenue total along with its biggest-ever economic loss even before the club potentially kicks a ball in next season’s Championship.

While Aston Villa and Norwich City will have seen significant uplifts in revenue given their respective promotion season revenues in 2018-19, Covid-19 will reduce expected 2019-20 revenues by a potential combined total of approx. £44.83m should 18th place be achieved.

As we have already highlighted, the financial position of the clubs when relegated from the Premier League normally deteriorates. In the case of the cohort of clubs to be relegated in the 2019-20 season, the situation is further amplified by the effects of the virus.

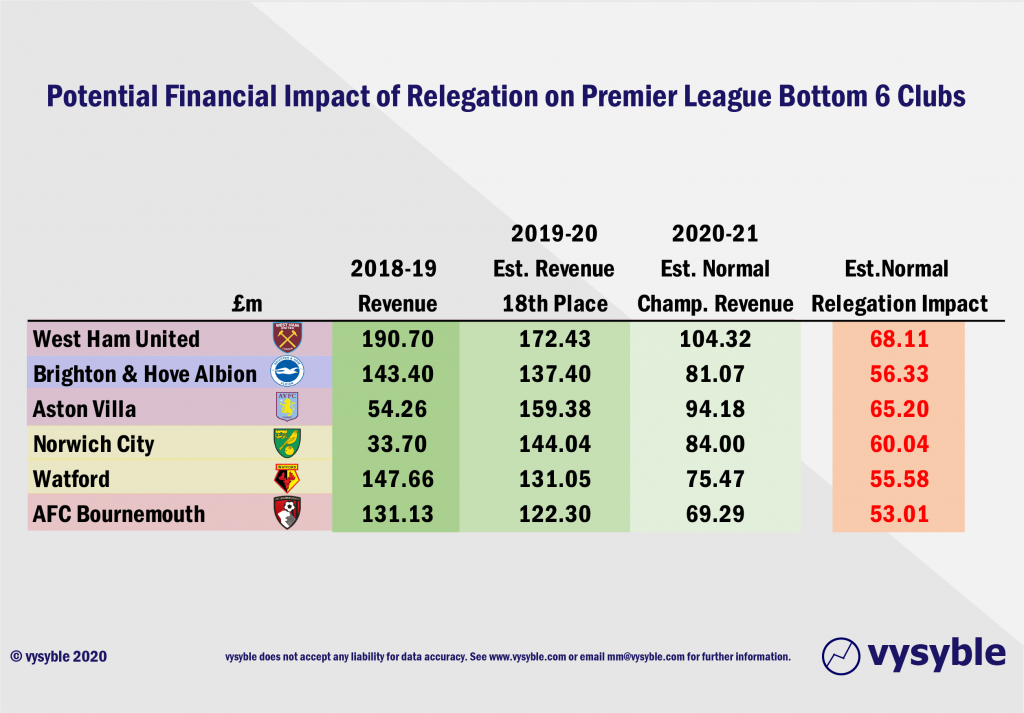

When we apply our average % reductions to each of the clubs for that first season in the Championship (TV – 45%, Matchday – 21%, Commercial – 38%), based on a normal season, we see the following values:

Again, West Ham United stand to lose the most under normal conditions – £68.11m in lost revenue due to relegation with Aston Villa close behind on £65.20m. But when the effects of Covid-19 are considered, the picture darkens further.

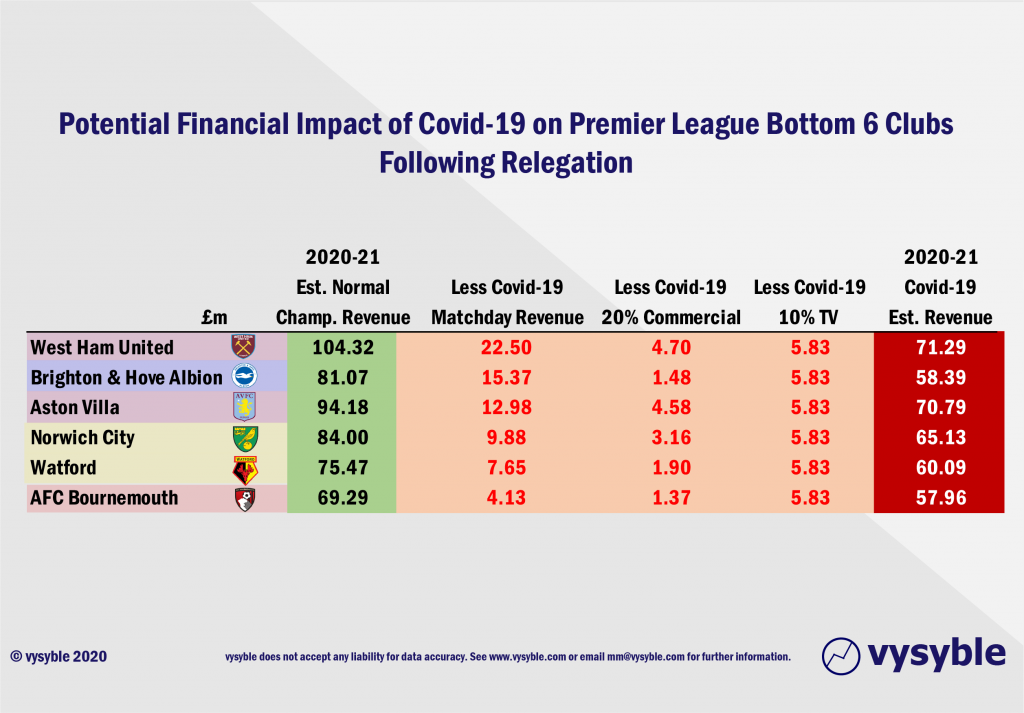

Firstly, we use the normal 2020-21 estimated revenue as the starting point. We will assume that closed door football will remain for the duration of the season i.e. zero matchday revenue, and an already-reduced Championship-level commercial income is further reduced by 20% due to the effect of the virus.

Once again, the TV aspect is the most complex and challenging issue. Two points to note – first, the bulk of the TV money in a first Championship season following relegation is from the parachute payment scheme (wherein clubs are given an additional amount of money from Premier League coffers to ‘cope’ with relegation). The second is the value of the EFL’s own TV contract with Sky.

The Premier League will be facing the prospect of further rebates due to probable rescheduling and closed door football for the 2020-21 season. Therefore, the financial muscle of the majority of Premier League clubs is going to be very much reduced and, in these circumstances, we think this will in turn put pressure on the funds allocated for parachute payments. We have not yet seen any reports regarding a potential alteration or rebate to the EFL broadcasting contract so we cannot forecast with any degree of certainty or reason what a potential reduction might look like but common sense would suggest that if the Premier League financial ecosystem is under threat then expect the parachute payments to be reduced accordingly.

On balance, we can make an educated/based on experience/ take a conservative viewpoint guess that the TV element for relegated clubs might decrease by a (conservative) value of 10% purely as a result of the more-restricted financial circumstances of the senior clubs and a reflection of the size of the Premier League’s own rebate (approx. 10-11% based on 2018-19 numbers) back to the TV companies.

If we then apply all the Covid-19-related reductions to what we would normally expect to see as a result of relegation, we arrive at the following;

West Ham United would therefore perhaps lose out on approx. £33m of Championship revenue as a result of no matchday income, reduced commercial income and a hit to TV revenue.

When we look at the combination of Covid-19 effects should relegation in 18th place ensue plus a season in the Championship, the potential outcome across all the clubs is very stark indeed;

So, to return to the revenue progression under normal circumstances from 2018-19 to 2020-21 should West Ham United be relegated, the revenue levels are estimated as follows: £190.70m -> £172.43m ->£104.32m.

With Covid-19, the revenue progression is £190.70m -> £144.73m -> £71.29m as the table of estimated revenues for all of the considered clubs illustrates below;

Three of the six clubs (unless one of the clubs above this group in the current Premier League table has a really poor period of form upon its return) will be relegated. And as a reminder, all six clubs collectively achieved an economic loss of £201m in 2018-19.

There are plenty of assumptions in this analysis and we are certain that our numbers will be somewhat incorrect, but we do not think that they will be out by too much.

As the above table clearly demonstrates, should restrictions persist, 2019-20 will be bad. 2020-21 will be brutal. Unlike revenue, losses will be plentiful.

As our headline quote from the film ‘Jaws’ implies, the clubs will need a sizeable boat of resources to survive if our numbers do hold as the waters are deep and the sharks sense a feast.

vysyble

Follow vysyble on Twitter