7th November 2019

In the November 2019 presentation of the company’s interim numbers (accompanied by the catchy strapline ‘Far reaching change – delivered at pace’), M&S announced a pre-tax profit of £176.5m for the six months ended 28th Sept 2019 which is down 17.1% from the £213.0m comparable announced this time last year.

We have previously written about the performance of M&S and the company’s erstwhile dominance of the UK High Street, most recently just a few weeks ago. Indeed, we hold Archie Norman, the current Chair, in high regard.

However, given the almost daily torrent of bad news from companies trading in and exposed to the UK High St, the conclusion might be arrived at that as far as M&S is concerned it is something of an achievement that the company is, to paraphrase a line from Elton John, “still standing.” With the possible exception of JD Sports, the view from the UK High St is one of increasing gloom and despondency.

The CEO’s perspective (taken from the Interim Statement)

“Our transformation plan is now running at a pace and scale not seen before at Marks & Spencer. For the first time we are beginning to see the potential from the far reaching changes we are making. The Food business is outperforming the market. Our deal to create a joint venture with Ocado is complete and plans to transition to the M&S range are on track.

In Clothing & Home we are making up for lost time. We are still in the early stages, but we are clear on the issues we need to fix and, after a challenging first half, we are seeing a positive response to this season’s contemporary styling and better value product. We have taken decisive action to trade the ranges with improved availability and shorter clearance periods. In some instances, dramatic sales uplifts in categories where we have restored value, style and availability illustrate the latent potential and enduring broad appeal of our brand. Our cost reduction and store technology programmes are on track.”

The above statement, if nothing else, is potentially encouraging and at least tries to give the impression of a management team with a certain degree of purpose.

That said, we believe that there will be pressure and potentially some merit in detaching the food business perhaps via a separate flotation. It is strategically interesting but fraught with operational challenges.

The company’s performance through the Market Value Added (MVA) lens.

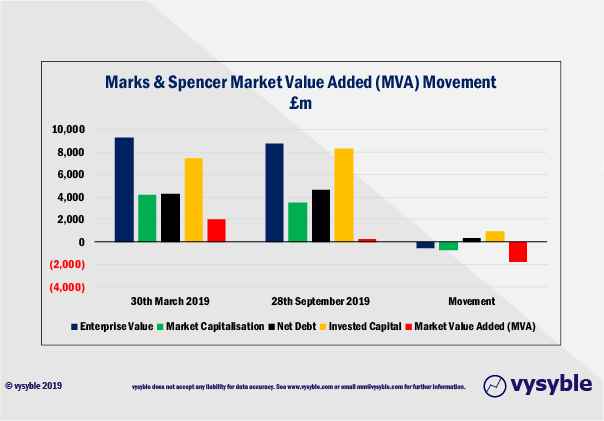

Recent developments do leave us concerned. At the time of writing, M&S shares are trading around the £1.90 level which according to our calculations produces an Enterprise Value (EV) of £8.57bn. If we deduct our calculation of Invested Capital ie £8.33bn (from the recently published “interim” balance sheet) to establish the “Market Value Added (MVA)” position as of 28th September 2019, we find that MVA is marginally positive to the tune of £240m.

In other words, the collective wisdom of the capital markets has reached the conclusion that the company will just about cover all of the costs of doing business going forwards, hence the discounted future stream of value creation (or fundamental value) is marginally positive.

By way of context, back in 2010 the company produced an economic surplus of £217m in a single year! Furthermore, a share price of £1.78, based on the most recent balance sheet, would bring MVA down to zero. In other words, the market perspective predicates a zero discounted future stream of value creation. Against this background, the capital markets would appear to have significant doubts regarding the current strategy of the business and the likelihood that the “five-year plan” is really going to turn the business around.

Set out below is a diagram showing the movement from the end of March 2019, which is the date of the last set of annual results, through to the date of the interims for 2019/20.

Of course, much of the downward movement comes from the decrease in the share price from £2.78 at the end of March 2019 down to £1.90 in September which realises a fall of 88.9p or 31.8%. In market capitalisation terms and following the recent rights issue, the drop in price equates to around £0.8bn or 18% of the market capitalisation at the end of March 2019.

Management teams frequently argue that the capital markets and share prices are subject to movements and forces outside of their control and don’t fully comprehend their strategies. Over the short-term we believe that there might be something in this but given the sustained fall evidenced over the last six months we caution against too much reliance on the notion that the “markets don’t understand us” sentiment.

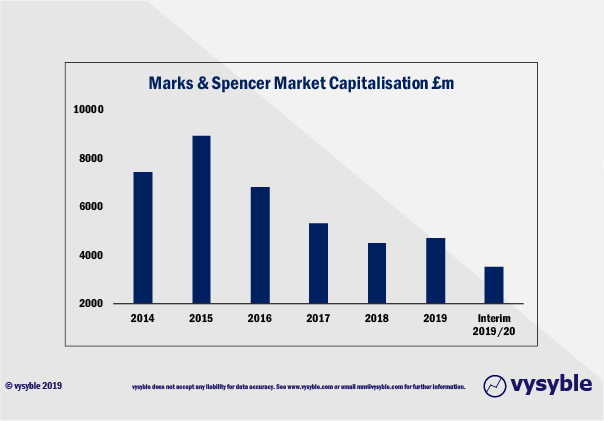

Set out below is the Market Capitalisation position at the date of each Balance Sheet since 2014 and the 2019/20 Interim Statement. The decline is both large and well established.

What does the picture look like from a Fundamental Value lens?

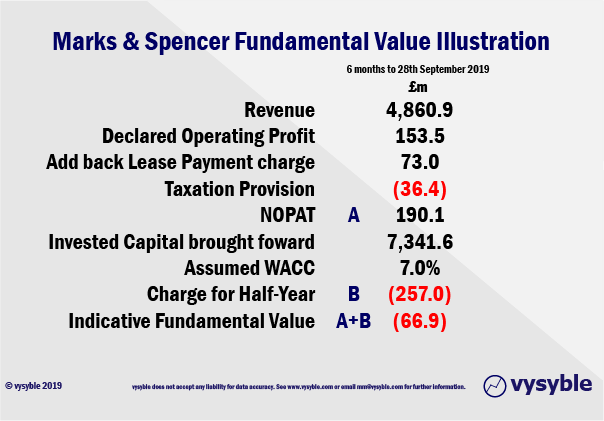

Set out below is our initial calculation of fundamental value – NOPAT (Net Operating Profit After Tax) less a charge for all the capital used by the business.

When viewed through the fundamental value lens, one might conclude that the most recent economic result is hardly aligned with the notion or the rhetoric that the recovery of the business is well advanced. Furthermore, it lends weight to the argument that the capital markets are more right than wrong in their assessment of the share price.

The above calculation is telling us that over the last six months the management team has taken £66.9m of the company shareholding wealth and, through their strategies and decision making, have effectively given it away to other stakeholders.

Of course, we would advise caution against drawing too many conclusions from a single period of economic profit. However, our initial workings reveal that from 2017 to March 2019, cumulative economic losses exceeded £1bn .

This is clearly a business caught in a very challenged situation.

Conclusion

We would not be amazed if a full value audit revealed something like the following:

- The majority of Marks & Spencer stores across the UK network are economically marginal and have been for quite some time. We suspect that the landmark stores in London Marble Arch, Manchester, Birmingham, Edinburgh and Newcastle etc are locations where value is likely created.

- That the property portfolio is too big and predominantly in the wrong locations for the current environment.

- That not all of the M&S customers are adding value – and that “marketing” could actually be targeting the wrong customer segment.

- That incentives for the senior team are misaligned with driving value for shareholders.

- That the current strategic priorities are poorly aligned with the underlying economic engine room of the business.

- That a very powerful “institutional imperative” is hampering or even blocking attempts to change the business. We find it worrying that there are, according to the interim statement, repeated issues with clothing lines “misaligned with a family customer profile.”

We don’t for a second pretend to be remotely qualified to discuss the merits or otherwise of the M&S fashion offer. However, we do wonder whether a customer proposition based on a “growing family of businesses under the M&S brand” is really the value-maximising way forward for shareholders.

Perhaps a more targeted and older/wealthier customer segment might be a proposition likely to yield more encouraging results?

Vysyble