The Oil Majors – Update

8th January 2021

Introduction

We have previously commented on the recent fortunes of ExxonMobil. It was once one of America’s great companies and is currently under attack from several shareholders, most notably Engine No. 1. Since the publication of our previous blog on the subject in December 2020, the company has released its third quarter numbers. In addition, we now have the year-end share prices from which we can go on to finalise the total shareholder return (TSR) numbers for 2020.

There is no denying that the Covid-19 pandemic has had a dramatic and pernicious impact on the trading conditions of the four major oil producers under review ie BP, Royal Dutch Shell, Chevron and ExxonMobil. However, our hypothesis is that the longer-term economic performance of the business and the consequent performance for shareholders reveals that the strategic challenges facing the company predate by some years the onset of Covid-19.

Recent Performance

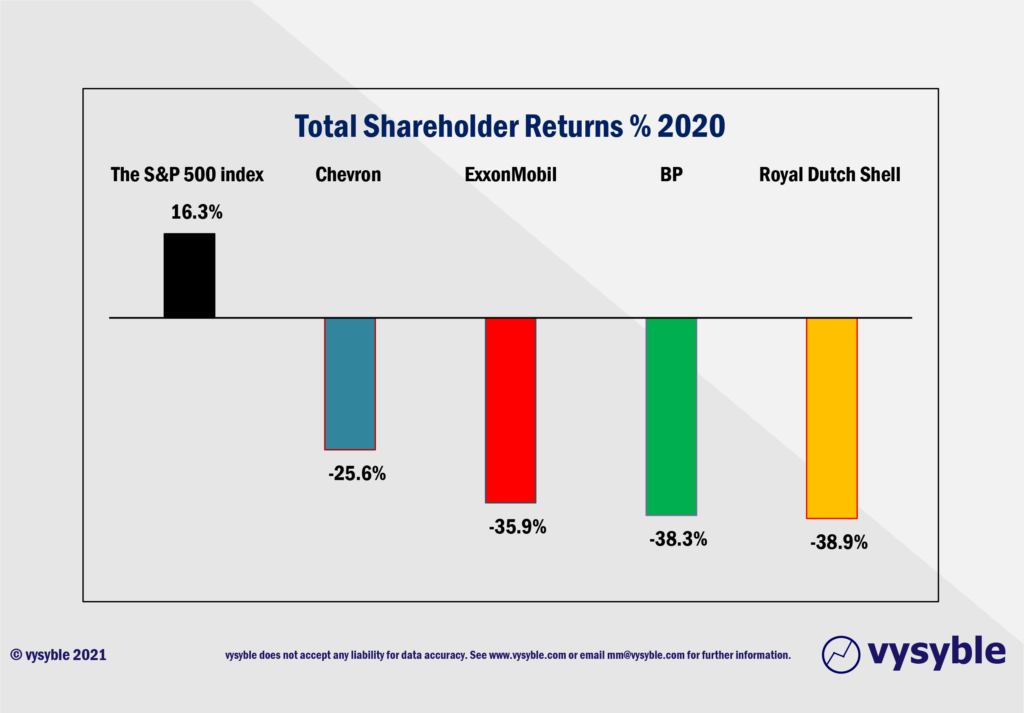

To begin with, let us look at the TSR performance of the four companies against the S&P 500;

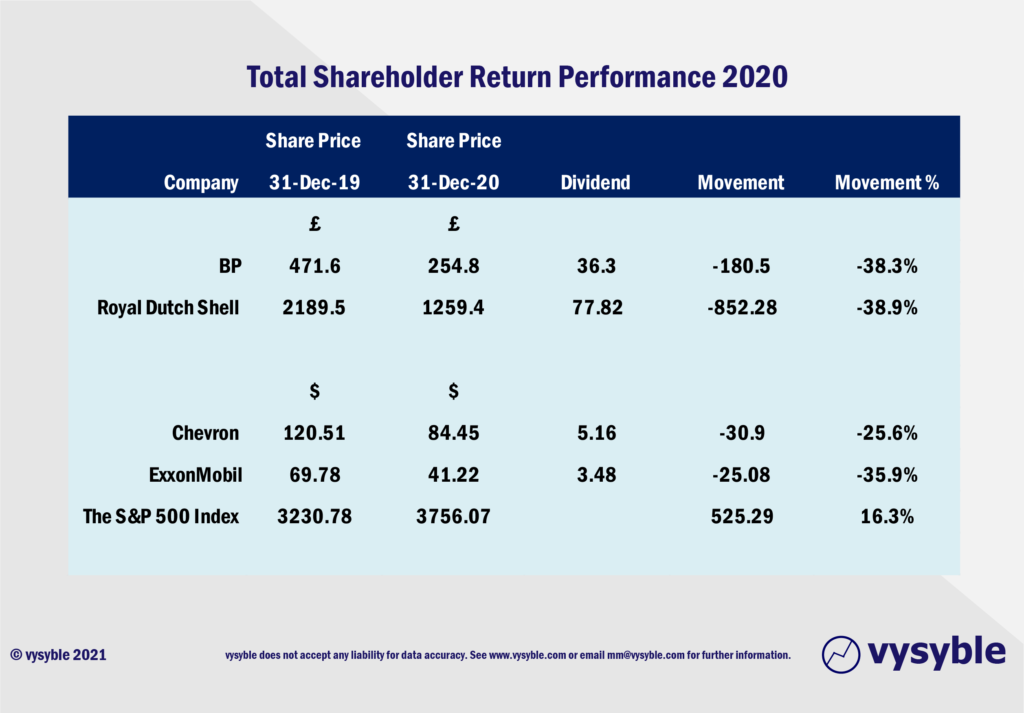

The data behind the above chart is illustrated below;

In effect, the differential in TSR performance between the S&P 500 and the lowest performance value of the above sample (Royal Dutch Shell) is a staggering 55.2% (38.9% + 16.3%) and for ExxonMobil it is an equally worrying 52.2% (35.9% + 16.3%).

A Longer-Term Perspective

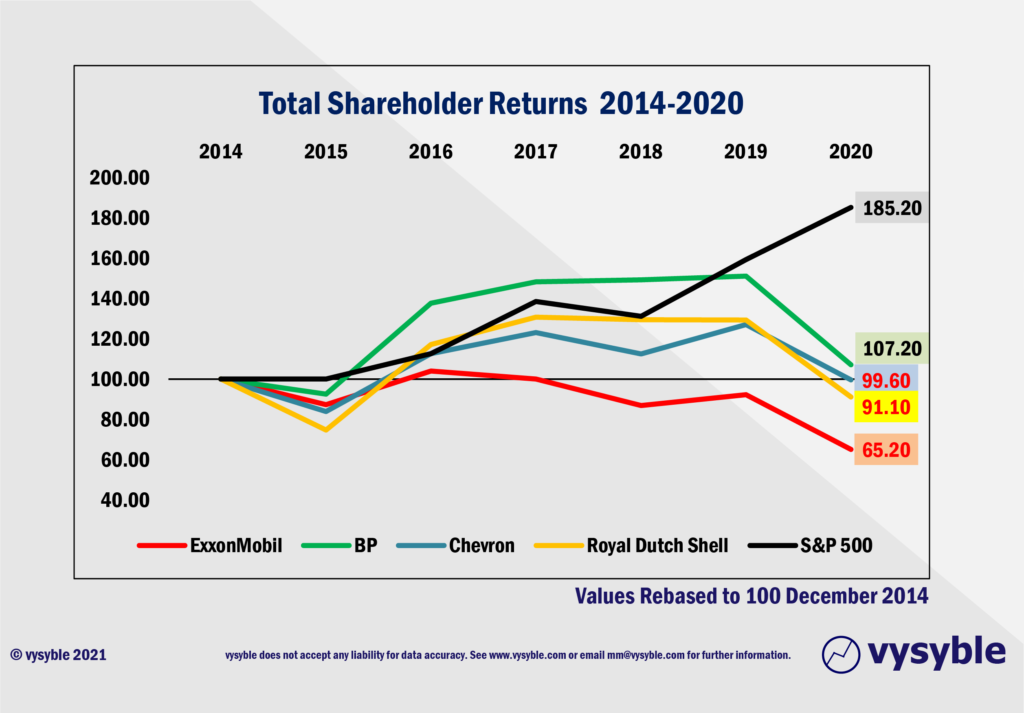

Of course, we would always argue that whilst the TSR performance over the past year is indeed interesting, a more informed perspective requires analysis over a longer period. Accordingly, set out below is the TSR performance of the four oil majors against the S&P 500 rebased to 100 in December 2014 – a six-year period.

The above chart clearly demonstrates that from around the middle of 2015 through to the end of 2020, ExxonMobil has significantly underperformed when compared with its three principal competitors. Over the entire period, BP is the best performing share, ahead of both Chevron and Royal Dutch Shell.

However, the broader point is that from a shareholder perspective, ExxonMobil has been significantly adrift of its competitors for a considerable time period.

Economic Performance

We believe that share prices are driven by multiple, often obscure, forces. In the end, the fundamental financial performance of the business and expectations thereof is the most significant long-term driver of share prices and, by inference, market valuation. Again, we believe that the best indicator of fundamental financial performance is Economic Profit defined as NOPAT (Net Operating Profit After Tax) less a charge for ALL of the capital used by the business. It is a measure, which unlike accounting profit and the rather suspect ‘EBITDA’ includes ALL of the costs of running a business and therefore gives a much more informative picture of business activity.

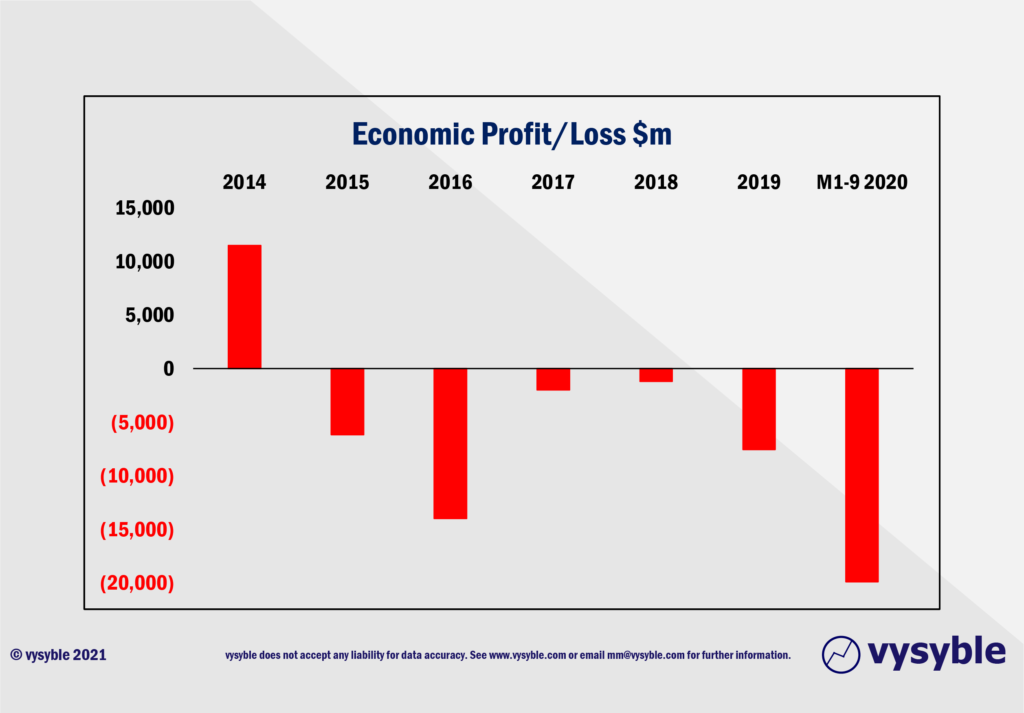

Set out below is the economic performance of ExxonMobil from 2014 through to the third quarter of 2020 ie the 9-month period ending 30th September 2020;

Thus, some facts regarding ExxonMobil’s economic performance…

- The last time the business covered all of its costs and produced an economic surplus was back in 2014 with an economic profit of $11.5bn.

- Over the above period, the total economic loss is a hefty $39.3bn.

- The average annual loss over the 6.75 years from 2014 through to the end of September 2020 is $5.8bn.

- In the first 9 months of 2020, the economic loss stands at $19.8bn. This is £12.2bn greater than the 2019 annual total of $7.6bn, which in itself is an indication of how hard the pandemic has hit the business.

- When examining the company’s economic track record, it is difficult to argue that the capital markets are being irrational in their assessment of the company via its share price.

For the sake of clarity, the economic profit measure combines three things: information from the profit and loss account, the balance sheet and capital market expectations via the “Beta” within the cost of capital calculation.

In our view, such a combination gives the metric a signalling attribute with clear advantages over return on investment, earnings per share or even cashflow.

Of course, there is more to business strategy than a relatively straight forward economic profit calculation but, that said, the choice of performance objective has a profound impact on strategy and its formulation. For instance, a company that decides to select or gives precedence to ‘return on investment’ will have markedly different strategies to that of a similar company focussed on earnings per share. In fact and from experience, the wrong choice in the performance objective is often the root cause of strategic difficulties further downstream.

We do firmly believe that the Boards of publicly quoted companies should have a performance objective of maximising economic profit and its growth over time. We see no reference to economic profit or this objective within the ExxonMobil Annual Reports.

Let us emphasise once again, no one is denying that the pandemic has been ruthless in its consequences for the major oil producers. However, as the above analysis clearly reveals, the challenges facing the executive team at ExxonMobil long predate the pandemic and its onset.

vysyble

Follow vysyble on Twitter

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.