22nd February 2021

Around this time of year, our thoughts typically turn to the first jottings in the planning and production of the next (6th) edition of ‘We’re So Rich Its Unbelievable! The Illusion of Wealth Within Football’ which is our annual review and comment on the finances and economics of the beautiful game.

Usually by February, we have a reasonably good idea of what we are going to write and the key themes that have driven football’s precarious financial path towards further turmoil. However, this ‘year’ is rather unusual in that many clubs are later than normal in publishing their annual numbers largely as a result of the three-month Companies House filing extension as a result of the COVID-19 pandemic.

At the time of writing, we have the 2019-20 accounts from 10 Premier League and EFL Championship clubs from a total of 44. A small number perhaps but contained therein are a number of clues as to just how bad things are even though the pandemic has ‘only’ affected 4 months of the 2019-20 financial year for the vast majority of clubs.

In addition, we have the near-real time data from Manchester United which, by virtue of its listing on the NYSE, has to provide quarterly updates on its financial performance which are usually two months or so behind the actual events themselves.

Finally, we have the historical financial accounts from the clubs concerned from which a number of educated guesses can be made in terms of, for example, lost matchday revenues etc.

Therefore, this financial triangulation at least provides an early if somewhat incomplete insight into the further deterioration of what was an already significantly weakened financial position.

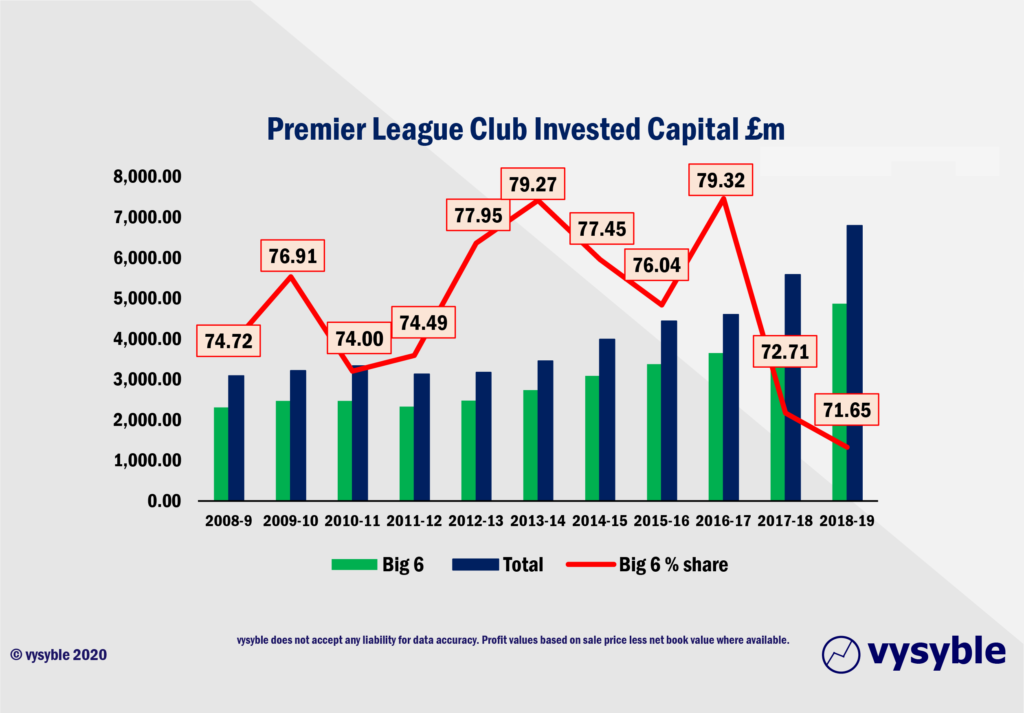

There is one aspect of the 2019-20 accounts that stands out from the previous year and which captures attention. In 2018-19 we saw the level of invested capital on Premier League club balance sheets increase significantly from £5.58bn to £6.79bn ie 21.6%. Indeed, since 2016-17 which was the first year of the then-record breaking TV deal and bumper pre-tax and economic profits in the Premier League, the level of invested capital has increased by £2.1bn.

On a historical basis, the vast majority of the ‘capital flow’ was driven by the Big 6 clubs (see below). However, 2017-19 has seen that flow, in percentage terms at least, reduce as the mid-ranking Premier League clubs such as Everton and Leicester City expand their horizons.

The reason for bringing this to your attention is that in 2018-19, the favoured but woefully incomplete business performance measure of Pre-Tax profit/loss on clubs balance sheets showed a relatively tolerable collective £169m accounting loss for Premier League clubs. However, the economic profit/loss performance for Premier League clubs in 2018-19 which covers all the costs incurred by the business including all of the costs of invested capital (financed by equity and debt capital) sitting on the balance sheet came to a record £599.54m loss. Club owners had been busy pouring money into loans and converting some of those loans into more shares thus expanding their invested capital numbers.

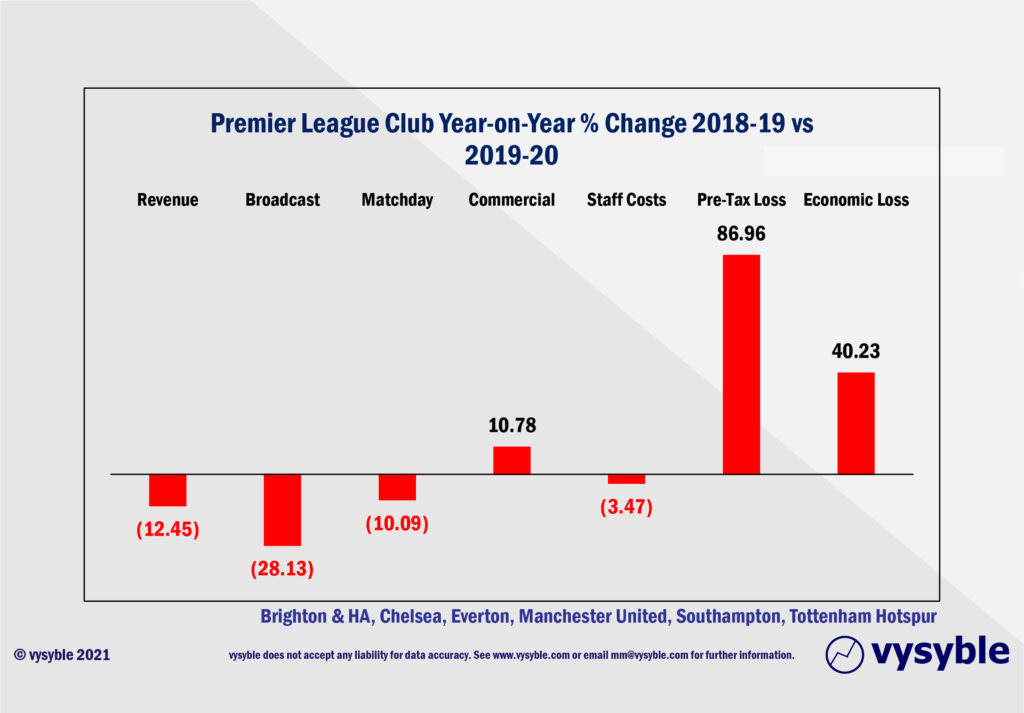

The early indications from the 2019-20 accounts already in circulation reflect the operational pressures that the clubs have faced since March 2020 when the first pandemic restrictions were put in place. When we look at the year-on-year comparison between those Premier League clubs that have released their 2019-20 accounts, we can clearly see that the Pre-Tax number has almost doubled in percentage terms whereas the economic performance number has increased by a lesser though still worrying 40%.

Thus 2019-20 club balance sheets, based on the evidence so far, appear to be withering with operationally-driven cash-in/cash-out measures highlighting the areas of strain. Given the restrictions on crowds etc. this is an expected outcome and one that can now be identified against the background of a record-breaking previous year (2018-19) for economic losses.

Meanwhile, the economic profit/loss number continues to grow as it includes the operational losses together with the burgeoning cost to owners as they try to shore up their club balance sheets with even more loans and equity. In particular, the adoption of short-term finance from entities such as MSD Holdings and Macquarie comes with an expensive price tag. With the cost of money currently running at around 4% for those Big 6 clubs that have already drawn down on their available credit lines, the remaining clubs are forced to pay more. Southampton pays 9.14% on its MSD loan. A clear case of ‘haves’ and ‘have nots’.

The true economic loss for the 7 Premier League clubs with 2019-20 accounts in the public domain has already reached £530m which is not that far behind the total economic losses for all Premier League clubs in 2019-20 of £599.54m – a record in itself.

Of course, values may go up or down as clubs continue to release accounts but let us return to the near-real time data (or drama) of Manchester United. The club’s second quarter performance for 2020-21 financial year is imminent. The two previous quarters ie Q4 2020 and Q1 2021 have by our calculations have achieved economic losses of £49m each. The total economic loss achieved by the club in 2019-20 was £77.89m.

If Manchester United is an early bellwether for what is to come in terms of the accounts for 2020-21, then 2019-20 will be comfortably surpassed.

Measure for measure, the picture is very bleak indeed.

vysyble

Follow vysyble on Twitter

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.