26th April 2021

Introduction.

GlaxoSmithKline (GSK) is a British-based multi-national pharmaceutical giant. With revenues of just over £34bn, the FTSE 100 company enjoys extensive business interests across the globe.

GSK is omnipresent in the UK’s pension plans, both private and employer-based, largely as a result of the historically generous dividends the company pays on a regular basis. In April 2017, the company’s Board appointed Emma Walmsley as CEO. On the 26thJuly 2017, the company announced to some fanfare a new strategy.

The company’s share price closed at £15.86 the previous evening.

The ‘New’ Strategy.

The key themes and headlines included:

- Balanced business to deliver sustainable growth and returns to shareholders

- Need to improve long-term performance and build off recent momentum

- Need to improve focus and output of Pharma R&D

- Investment spread across too many projects

- Opportunity to improve development timelines

- Adjusted EPS to grow mid-to-high single digits.

- “So, under my leadership, all three businesses will be tasked to be focused on three long-term priorities:

- Innovation

- Performance

- Trust.”

All of this is potentially interesting and clearly a lot of work within the business was undertaken. However, in reality this is no more than a series of good intentions in the same vein as committing to drink less, to exercise more and to go to church on Sundays.

It is not a strategy as such, but more a list of desired and, for the most part, well-intentioned outcomes.

However, one wonders why a ‘balanced business’ is a desired result? If by “balanced” we mean equal and counter-cyclical, then by definition the company can only produce average returns. Presumably, the management team at the time of the strategy deliberations aspired to more than that?

There is an acknowledgement of “trust issues” between the company and its stakeholders and a general indication that the management team need to be more transparent in their work. All very welcome, but where or what is the governing objective? Indeed, how is the executive team going to manage the dilemma of competing strategic alternatives? The strategy statement, for all of its good intentions, is at best vague. How will the inevitable trade-offs between innovation, performance and trust be approached and managed effectively?

Evidently, the company wants to grow earnings per share (EPS) at mid-to-high single digits. Unfortunately, whilst earnings per share may be a widely adopted measure, it is a poor and incomplete measure of performance from an economic and a strategy perspective and is therefore not a reliable indicator of value creation. Thus, it is not a particularly helpful benchmark in choosing between strategic alternatives, many of which will be mutually exclusive.

Furthermore, a reliance on EPS can actively encourage the executive team into making decisions and to indulge in behaviours contrary to the interests of shareholders and other stakeholders. This is a ridiculous position often reinforced by out of date and fundamentally unsound remuneration incentives.

Common Mistakes in Strategy Formulation.

Over the years the following are sadly more often encountered than not:

- Strategy has the wrong objective (or unclear / confused objectives)

- Strategy discussion dominated by “visions & missions”

- Strategy is viewed as a periodic event rather than an on-going process

- Strategy is not fact-based – too much reliance on “judgement and experience”

- Strategy has an inadequate economic underpinning

- Strategy is more a presentation or a ritual than a debate

- Strategy is too internally focused.

- Strategy does not drive management priorities and actions

- Strategy is delegated to outsiders

- Even worse – strategy is delegated to Finance Dept.

- Hubris creeps in….

Worryingly, we think that GSK has fallen prey to several of the above…

Here are the tests that we would apply to evaluate a strategy for any given organisation:

- The Governing Objective test.

- Does the strategy set out to maximise the value of the business by maximising the growth of future Economic Profit whilst taking into account the wants and expectations of all Stakeholders?

- The Economic Framework test.

- Is the strategy based on a robust understanding of the economics of markets, customers, and competitors?

- The Factbases test.

- Is the strategy based – to a significant degree – on facts rather than opinions?

- The Alternatives test.

- Does the strategy process identify and evaluate alternative proposals in order to develop the value-maximising strategy?

- The Continuous test.

- Is the strategy process on-going and continuous in order to cope with and exploit threats and opportunities as they appear so that we always have the value-maximising strategy?

- The Execution test.

- Is the effective execution – and the adjustment – of selected strategies monitored and managed robustly?

Unlike the advice given in numerous business strategy books and publications, we argue that our approach in evaluating the quality of content in the strategic plan is a more robust and comprehensive process.

The Outcome for Shareholders So Far.

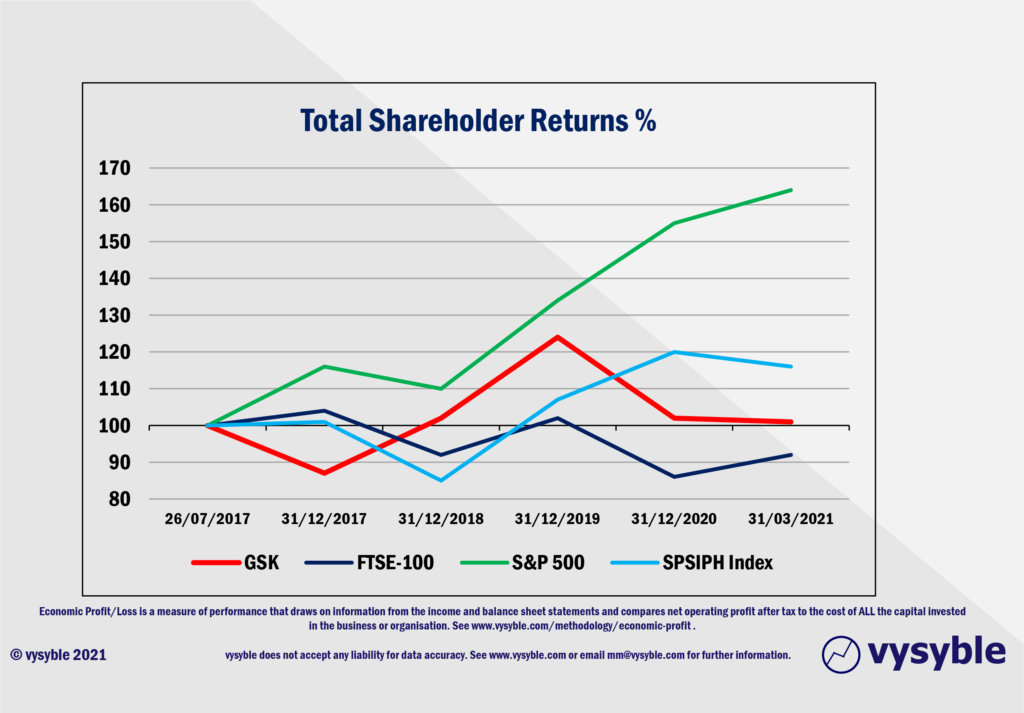

In the above graphic, we show the total shareholder return (TSR) performance of GSK against the FTSE-100, the SPX S&P 500 and the S&P Pharmaceuticals Select Industry (SPSIPH) indices from day prior to the GSK strategy announcement ie 26th July 2017, through to 31st March 2021. All data is rebased to 100.

When compared against the performance of the FTSE 100, GSK is clearly the superior performer. However, a comparison with the SPX S&P 500 index and the SPSIPH US Pharma index finds that GSK is clearly lagging, and by some distance; SPX achieved a return of 63.9% as the SPSIPH achieved a return of 15.8% over the period against GSK’s TSR of 0.2%. Therefore, GSK is undoubtedly behind in TSR performance against these specific comparatives.

On 31 March 2021, the GSK share price was £12.88, which is £2.98 (18.7%) lower than the closing price of £15.86 on the evening before the new strategy was announced. Thus, the ‘return’ under the new strategic regime has been driven by the dividend which, since the date of the strategy announcement, amounts to £3.01.

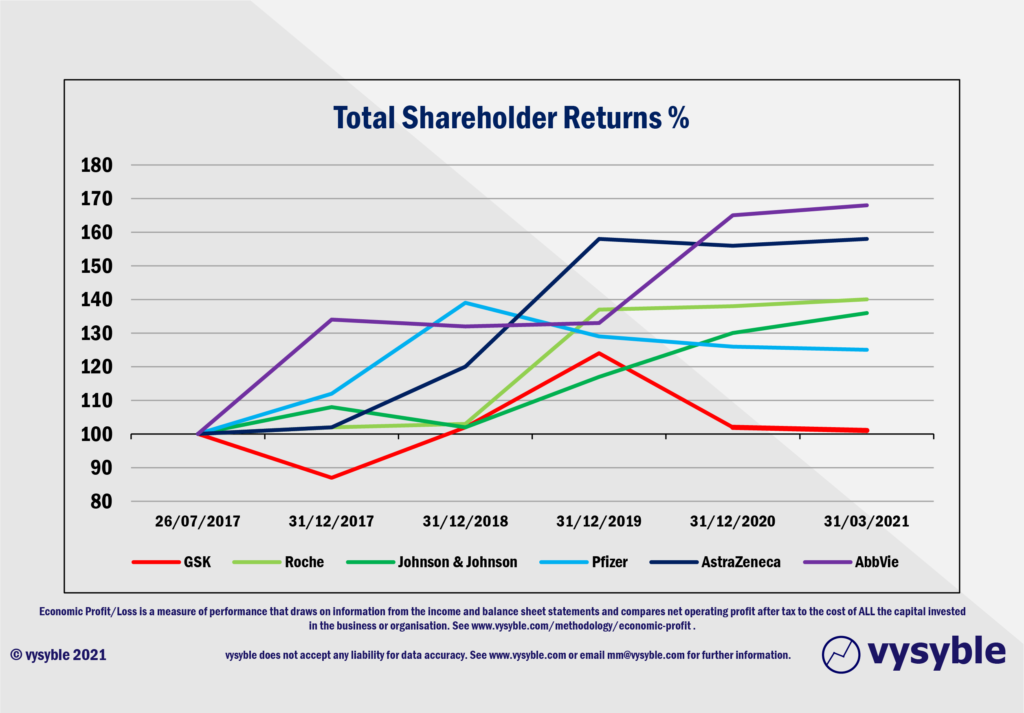

In the above graphic, we see the comparison between GSK’s TSR performance over the same period (26th July 2017 through to 31st March 2021) against a selection of Pharma competitors.

For GSK’s investors, it is not a reassuring picture. The company has been comprehensively outperformed in the capital markets in terms of total shareholder returns by AbbVie (a return of 67.8%), AstraZeneca (58.2%), Roche (40.5%), Johnson & Johnson (36.2%) Pfizer (25.3%) against GSK’s TSR of 0.2%.

In other words, £100 invested in GSK has yielded a 20p return as of 31 March 2021 versus £25.30 for Pfizer.

Therefore, given such a stark and worrying comparison it seems logical to state that the prevailing opinion of the capital markets is that the ‘new’ strategy as currently understood is not delivering significant returns for investors.

Dividend Cover.

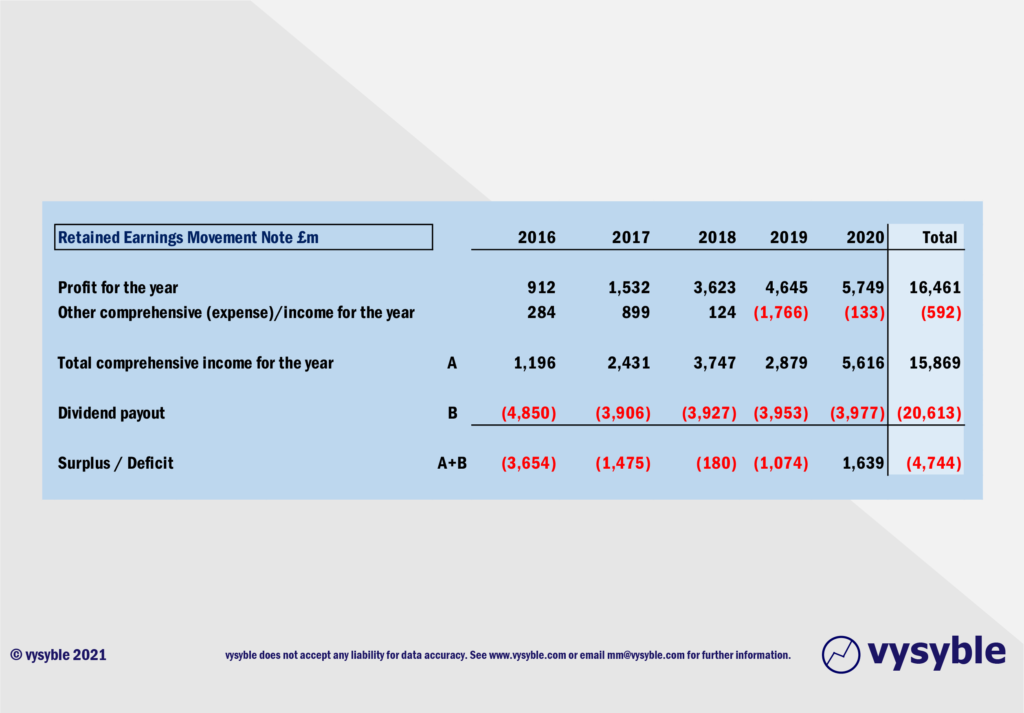

In the interests of clarity, the data illustrated above has been extracted from GSK’s annual reports. The good news is that for the year ending 31st December 2020, the dividend was covered by comprehensive income. However, over the last five years, GSK has paid out £4.75bn more in dividends than the level of comprehensive income generated by the company. Investors will inevitably spot this imbalance and may also argue that this situation cannot continue indefinitely.

As we set out earlier, the total shareholder return of GSK, such as it is, has been driven by the dividend pay-out yet the dividend outflow exceeds income generated. Not a good position to be in.

In other words, this is a cloud over the company’s ability to generate acceptable TSRs.

Economic Performance.

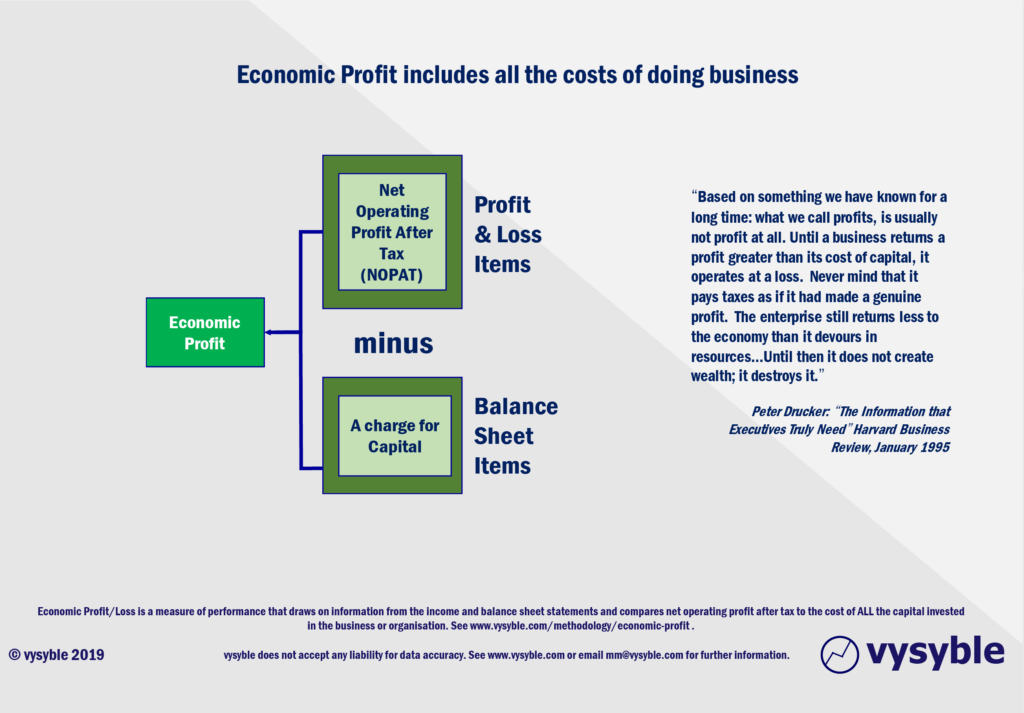

Normally, when we observe an increase in either economic profit (see below for definition) or in the rate or efficiency of economic profit delivery, we tend to see a commensurate increase in the TSR for a given business both in absolute and relative terms.

In that sense, adoption of the economic profit metric as the principal performance assessment metric is akin to bringing the discipline of the capital markets inside the business. Often, this is an uncomfortable experience for management teams…

The metric draws upon three sources of information; the profit and loss account, the Balance Sheet and the expected return from the capital markets expressed through the ‘Beta‘ in the calculation of the charge for capital. Consequently, it offers a signaling capability which is significantly superior than accounting-based metrics and even cashflow.

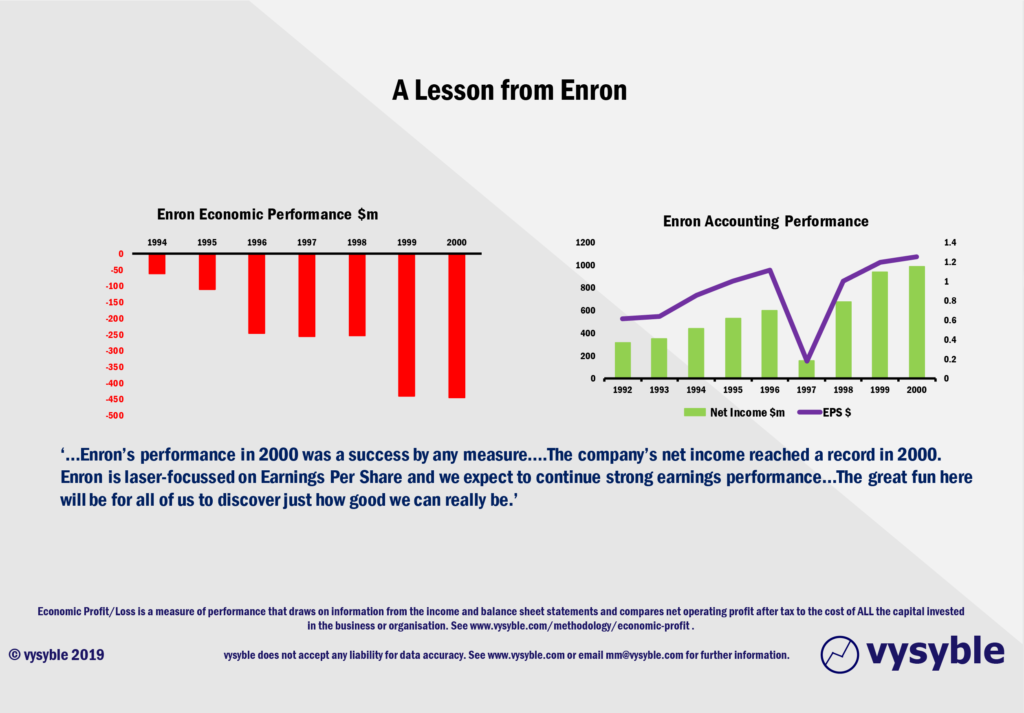

In the above example, we see Enron’s performance through an economic lens on the left-hand side, which shows a disturbing picture of value destruction and on the right-hand side accounting net income and EPS which suggests a relatively healthy performance picture. Given that Enron filed for bankruptcy in December 2001, we, being logical, would argue that the left-hand side was a far superior representation of the economic position of the business. The result was the biggest corporate collapse on record at the time.

So, how does economic profit performance drive total shareholder returns?

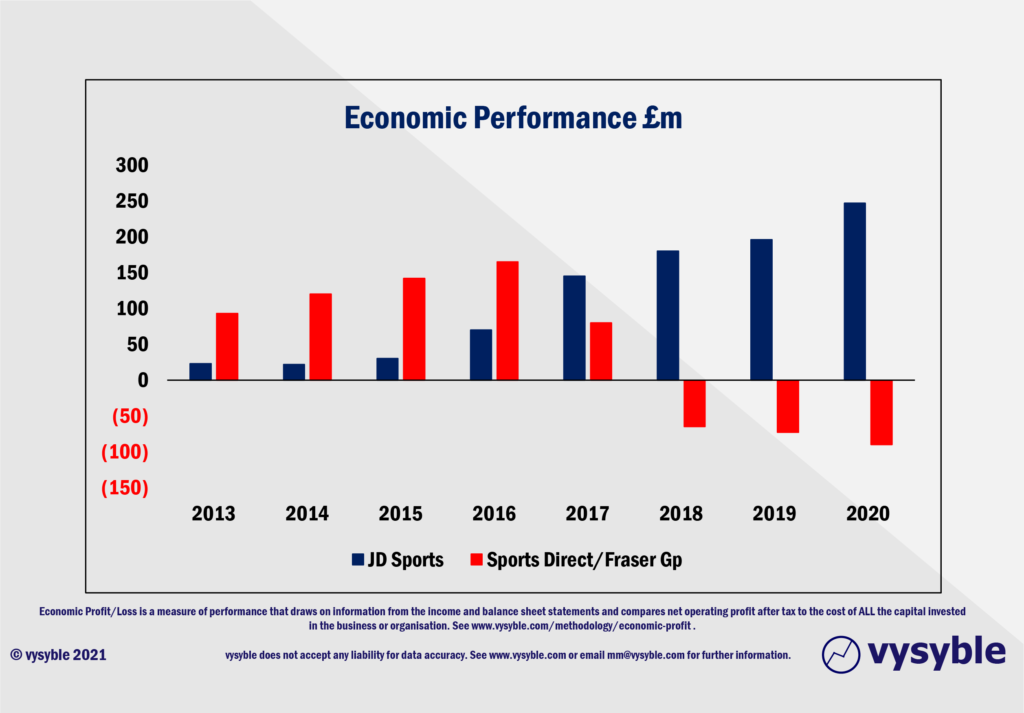

Set out below is an example, a comparison between JD Sports and Sports Direct / Fraser Group.

It is evident that JD Sports’ economic performance is superior to that of Sports Direct / Fraser Group from 2017 onwards.

JD Sports’ TSR performance is significantly ahead of Sports Direct / Fraser Group. The capital markets have, in effect, rewarded the company’s superior economic performance.

It is a simple and direct comparison to make but nevertheless an obvious one and we have numerous other examples on this website.

GSK’s Economic Performance.

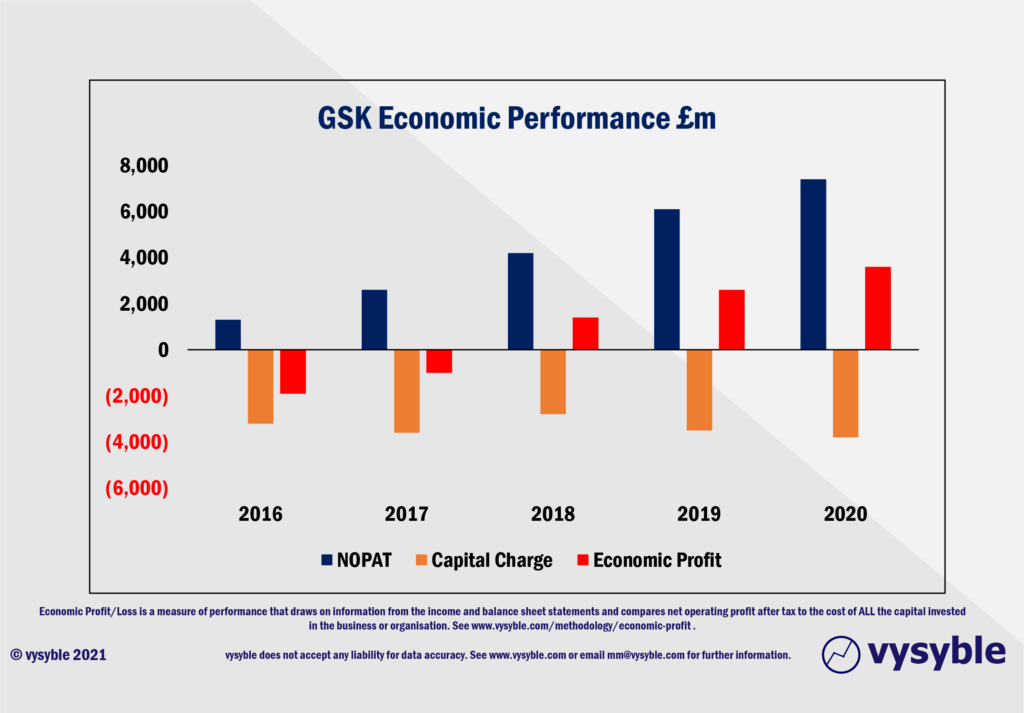

As illustrated above, GSK’s economic performance has improved from a loss of £2.03bn in 2016 to an economic surplus of £2.43bn in 2020, which represents an uplift of £4.46bn. All good so far…

Despite this, the GSK share price has fallen from £15.62 at the end of 2016 to £12.88 as of 31st of December 2020. A fall of £2.74 (17.5%) and against a backdrop whereby the share prices of the company’s major competitors have generally risen quite significantly.

At first, this is a puzzling development in that the economic performance of GSK has risen yet the value of the business has fallen both in absolute and relative terms. To get to the bottom of this conundrum, we need to take a deeper look within our calculations to establish a coherent hypothesis.

Market Value Added (MVA).

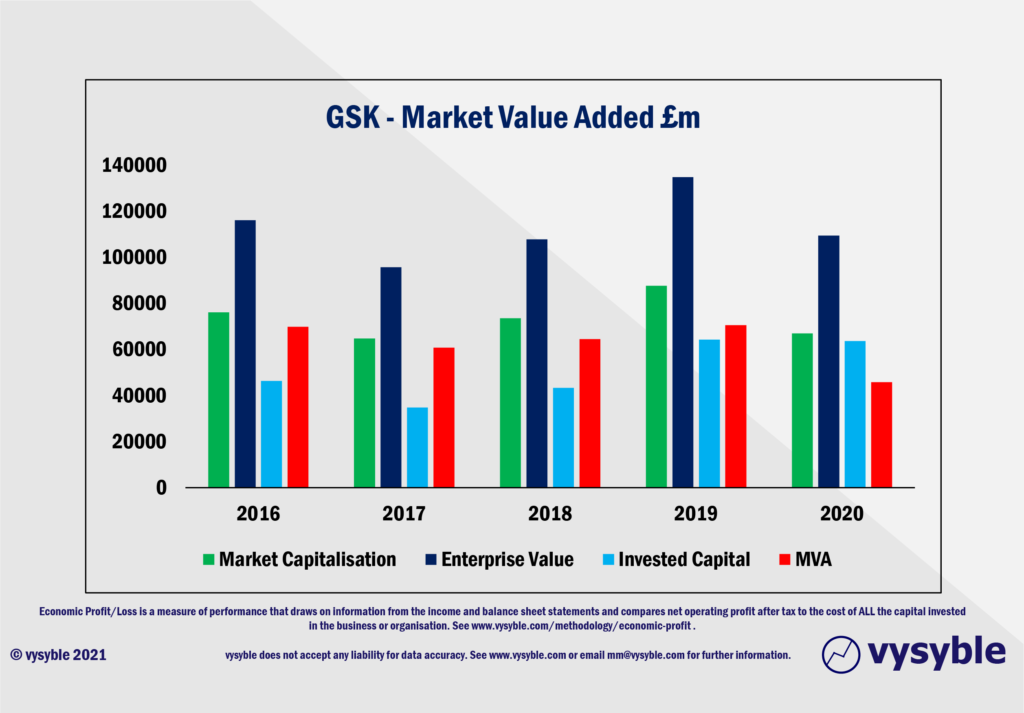

MVA, defined as Enterprise Value less Invested Capital, represents the capital market’s collective and capitalised view of the future stream of economic profit. In turn, the future stream of economic profit can be sub-divided or split between ‘current value’ which is the market’s valuation of the current business and the market’s assessment of value from strategies and initiatives over and above the current business that GSK will identify and prosecute over time (‘future value’). Set out below is a visual expression of MVA for GSK at the date of each balance sheet from 2016 through to 2020.

We have calculated market capitalisation using the nearest closing share price to the date of the balance sheet, the enterprise value incorporating information and numbers from the appropriate balance sheet, invested capital and the resulting MVA from 2016 through to 2020.

MVA at the end of December 2016 stood at £69.7bn but by 31 December 2020 it had fallen by £23.9bn to £45.8bn. All in all, a 34% decrease.

Question: How is this possible given that the company’s economic performance has improved?

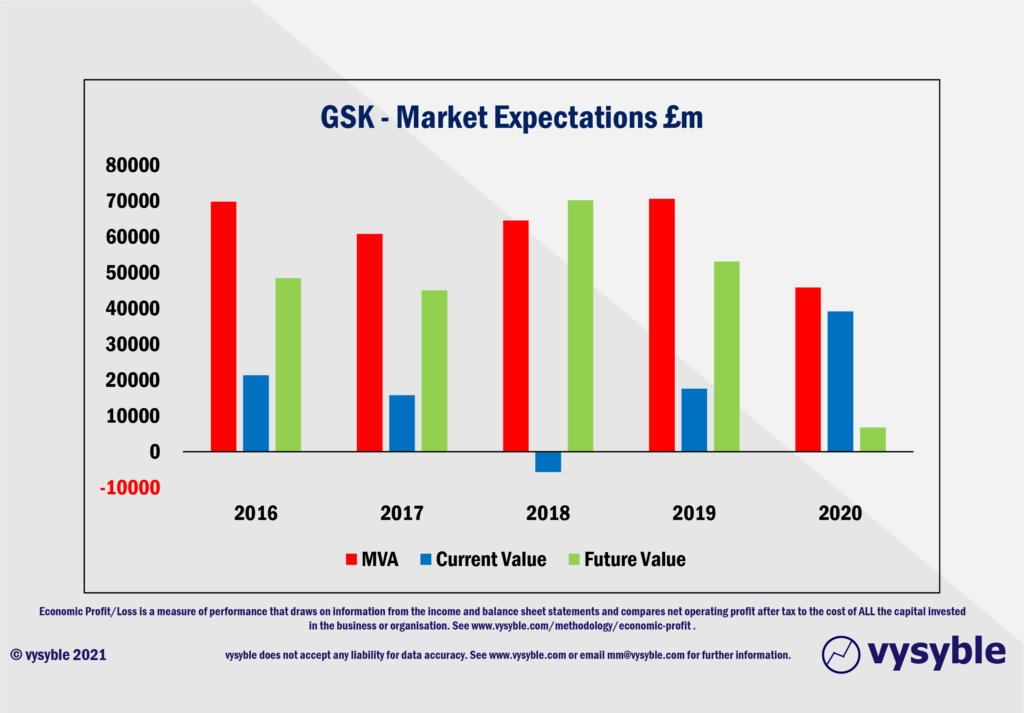

The graphic below reveals the result of our calculations regarding the MVA position, together with both the future value and current value levels. Therefore, what we have been able to do is to disaggregate the share price at a given date to reveal and unpick collective market expectations which have been incorporated into the overall price.

At the end of 2016, Future Value (FV) stood at £48.3bn. By 31 December 2020 it had fallen to £12.5bn; a negative movement of £35.8bn. Viewed through this lens, the market appears to have a collective doubt about the ability of the company to generate new lines of value creation over and above existing businesses ie the potential/new drug/product pipeline.

In the above calculations, we have applied a cost of equity capital value of 9%. Arguably, this is at the higher end of possibilities. If we were to use a cost of equity capital value of 7% at 31 December 2020, then FV at that date goes negative (as the cost of equity decreases, current value increases) to the tune of £8.9bn. In such a scenario, the collective wisdom of the capital market is such that it does not expect current performance levels to persist. Worrying…

Current Performance.

The GSK strategy as understood by the capital markets is not delivering when viewed on share performance against any conceivable set of competitors.

Since the end of 2016, the GSK Future Value component has all but collapsed which should raise serious questions about company strategy. From our perspective, far too much of the July 2017 strategy announcement rests on the “House of Good Intentions”.

There is no question regarding the zeal with which Ms. Walmsley has gone about her duties. One article in the Financial Times reported that 50 senior managers have left the business since she became CEO. However, zeal is no substitute for sound, disciplined, strategic thinking and in reading the July 2017 strategy announcement, and indeed subsequent annual reports, the language used to convey the company’s performance to investors is one of bland management-speak rather than a clear focus on value creation and shareholder returns.

To be frank, this is an affliction that is not solely confined to GSK. No doubt there have been huge amounts of effort along with the deployment of well-paid and well-meaning advisors to execute the design and delivery of the company message. However, it is not clear what the governing objective of the business actually is. We have to conclude that whatever ‘direction’ there is in place, it is (if it exists at all) hardly aligned with driving value for shareholders and by implication other important stakeholders.

Without a clear governing objective, we have to ask the question as to how will the executive team choose between the trade-offs that inevitably emerge with the management of a large, complicated, multi-product, multi-market organisation? Against this background, removing 50 or so top managers may attract warm headlines from the FT and others but without a clear governing objective, it is unlikely to land the ‘best in class’ performance award.

The 9 great mistakes commonly made by CEOs and their organisations…… which must be avoided…

- Failing to understand what drives value on the stock market (and let’s be clear it is most certainly not “earnings per share”)

- Setting the wrong objectives for the business

- Failure to see where value is created and destroyed

- Inferior strategy process and outcomes

- Undisciplined execution and updating of strategy

- Organisational structure and methods of working which are poorly aligned with creating value

- Inferior management ‘skill and will’ to manage value

- Ineffective at driving change

- Failure to understand and absorb the signals coming from the capital markets

There is much speculation in the press about splitting the business with the argument logic being that it might release latent value. However, we struggle to understand how such a move changes the fundamental cashflows of the business especially when the City will have taken its ‘fee jamboree’. Indeed, how are the businesses to be managed and driven forward after the split? If anything, it could be argued that more ‘cost’ and therefore a reduced cashflow is a likely consequence…

In the end cashflows or economic profits drive value on the capital markets and it is not clear, at least from our perspective, how the GSK management team would seek to drive the respective businesses post-split? Or, for that matter, more generally before GSK becomes once again a G and SK.

*Edited on 28th April 2021.

vysyble

Follow vysyble on Twitter

25th April 2021 – The Wrong Stuff – American-style football league won’t wash but the conditions that led to its launch are still present and are likely to get worse.

19th April 2021 – Super League Arrives – As we predicted, football’s elite breakaway emerges from the shadows.

30th March 2021 – $hooting B£ank$ – Arsenal’s commercial performance analysed.

22nd February 2021 – Measure for Measure – Take two financial measures, add pandemic and stir.

18th January 2021 – The Football Factory – If football was an industrial entity…

8th January 2021 – The Oil Majors – An Update – A shareholder return performance review of the 4 major oil companies in 2020.

10th December 2020 – Pump Up The Volume – ExxonMobil comes under fire from an agitated investor.

16th November 2020 – The Pain Game – Manchester United’s Q1 2021 financial release opens the lid on a Covid-19-affected financial can of worms.

11th November 2020 – A Tight Squeeze – Football’s Elephant in the Room leaving little space for financial relief.

29th October 2020 – Form and Function – Proposals-a-plenty for football’s structural reform.

13th October 2020 – Project Big Profit – Americans come bearing a proposal for football’s structural reform, just as we predicted in 2016.

8th October 2020 – Game Aid – Football is caught in the crossfire of indecision and financial necessity.

24th September 2020 – Crisis? What Crisis? – We look back 12 months at the demise of Thomas Cook and its relevance to more recent events.

11th September 2020 – Distance Learning – New rules and new values as Covid-19 challenges traditional mindsets and misconceptions.

19th August 2020 – Socked! Marks & Spencer’s Shrinking Value – Retail giant is fast becoming a shadow of its former self.

22nd May 2020 – You’re Gonna Need a Bigger Boat – An assessment of the double financial whammy of potential relegation from the Premier League and Covid-19.

30th April 2020 – Home, Alone – Initial indicators from the wider economy point towards economic and financial downsizing in sport.

6th April 2020 – Board Games – Government, football clubs and players adopt separate ‘brace’ positions as Covid-19 crashes the sports economy.

27th March 2020 – Markets, Mayhem and Manchester United – A look at the questions posed by the share prices of publicly listed businesses.

15th March 2020 – When Saturday Goes – Football has come to a halt. We take stock of the game’s position and ponder its return.

10th March 2020 – Futureworld – The potential economic effects of the COVID-19 outbreak.

19th February 2020 – Lemon Law – How Financial Fair Play can give a misleading view of football club finances.

8th February 2020 – Hammered – Our financial perspective on some of the clubs involved in the Premier League relegation battle.

12th December 2019 – The Cost of Chasing Gold– In collaboration with the BBC, we look at the high price being paid by clubs to gain promotion into the Premier League.

7th November 2019 – Where to Next for M&S? – November 2019 results suggests the retailer is losing its way

10th October 2019 – Red Mist – Manchester United’s 2019 FY numbers and the stagnation of England’s biggest revenue-earning club.

7th September 2019 – Not Just A Loss But… – A detailed look at the decline in Marks & Spencer’s fortunes.

29th August 2019 – Telling It Like It Is… – What really happened when we talked to the English Football League.

5th July 2019 – Chopping Board – Knives out for former Tesco chief.

25th May 2019 –Repeat Prescription – Few believed us the first time around regarding football’s financial plight…

19th March 2019 – Stuff and ‘Nonsense’– Why the Economic Profit metric is the most transparent measure of business performance.

13th March 2019 – Financial Fair Play – Guilty as Charged? – Our thoughts on FFP schemes and their key weakness.

18th December 2018 – Long Division – The Post-Ferguson years at Old Trafford have come at the expense of declining economic and on-pitch performance.

20th November 2018 – The Relegation Game – Tales of woe and economic performance at the wrong end of the Premier League table.

9th October 2018 – A Different View – Why fans ought to be acutely aware of football’s financial dynamics.

17th August 2018 – The End of the Beginning – La Liga heads west to conquer new worlds.

9th August 2018 – Reaching for Sky – the sequel – Latest offer price for satellite TV company is good for shareholders, less so for prospective owners.

8th August 2018 – American Dreams – English Premier League economic dynamics and American money – is a Euro Super League the next step?

3rd August 2018 – Mall Administration – Retail Property Co. bonus payouts at odds with increasing shareholder value.

20th April 2018 – Goonernomics Part Deux – The departure of Arsene Wenger…

18th April 2018 – The Price of Everything – Tesco’s latest numbers offer little in value.

12th April 2018 – Say What? – WPP’s very mixed message.

14th February 2018 – In Case of Emergency – Premier League’s UK TV rights auction comes up short.

7th February 2018 – Lost in Transmission – Top Premier League clubs look beyond domestic TV rights.

4th December 2017 – A Billion here, a Billion there… – The Premier League reaches a major milestone, quietly…

25th November 2017 – Getting out of Toon. – Is Mike Ashley pitching the sale price of Newcastle United at the right level?

16th October 2017 – Goonernomics. How the ‘Bank of England’ club falls short of its North London neighbour.

25th September 2017 – Highlights. More record-breaking numbers from the biggest football club in the land, but no economic profit…

23rd September 2017 – Football’s Economic Back Pass. A guest blog for the Soccernomics website.

12th September 2017 – Crystal Balls-up. Changing strategic direction is not a good idea when you haven’t looked at the economics.

27th July 2017 – Football’s Summer of Money and the £65 pint of beer. The sport that just can’t spend enough.

11th July 2017 – Football Special. Observations following the launch of ‘We’re So Rich…’

9th May 2017 – Illuminating, non? Political energy lacks vision and power.

2nd March 2017 – Claudio’s Burden. The price of failure outweighs the price of success.

12th January 2017 – Shopping for Godot. A never-ending quest for value in Retail.

27th December 2016 – Reaching for Sky. Is Rupert Murdoch’s £10.75 per share a fair price?

6th December 2016 – Auld Lang Syne. A reminder from history of the damage that poor financial planning can cause.

1st December 2016 – Fork Handles? Four Candles? Tesco’s blurred strategic vision.

27th November 2016 – Football’s Instant Replay. Financial warning signals for the top English Premier League clubs.